When using a Forex Broker, you may be worried about being denied withdrawals.

As an extreme example, there have been cases of unauthorized brokers refusing withdrawals or running away with customers’ funds.

In this article, I will explain the rumors about refused withdrawals at XM and what to do in case your withdrawal request is not accepted.

- What is a withdrawal rejection?

- Is there a withdrawal rejection in XM?

- What to do if your withdrawal is denied by XM?

What is withdrawal rejection?

Withdrawal rejection means that your request for withdrawal is not accepted by the forex broker and the money is not withdrawn forever, even though you have made a profit.

In the worst case scenario, your account may be frozen.

In the worst case scenario, the forex broker may take the client’s funds and lose contact with the client.

In particular, forex broker operate 100% online. They don’t have branches all over the country like banks do, and if you can’t get through to them by email or phone, you are out of luck.

How to avoid being denied withdrawals

In order to avoid being denied withdrawals, you must first understand and be aware of the following.

Use only trusted broker

The first prerequisite is to use a reliable vendor.

A reliable vendor is one that

- Has financial licenses

- Appropriate management of customer assets

- No bad rumors of withdrawal refusal

Financial licensing and proper management of customer assets is a minimum requirement.

In addition, brokers that have experienced many withdrawal refusals can be easily found by searching online or on Twitter.

If it is a well-known broker and you don’t find any mention of withdrawal refusals when searching online, you can assume that there are no withdrawal refusals.

Choosing such a forex broker is the first step to avoid being denied a withdrawal.

Follow the rules

In many cases, traders violate the rules when they are denied withdrawals even from reliable forex companies.

The rules are as follows.

- Rules for Withdrawals

- Rules for Trading

The rules regarding withdrawals refer to the withdrawal method, minimum withdrawal amount, etc.

If you make a request that is not in accordance with the rules, it will obviously not be accepted.

Trading rules refer to the use of bonuses and trading methods.

For example, you will be denied withdrawals if you have received bonuses illegally or if you have made profits by using prohibited methods such as cross-order between multiple accounts.

It is recommended that you understand all the rules before you trade.

Is there a withdrawal denial on XM?

In conclusion, there is no withdrawal refusal at XM unless you trade illegally.

I’ve sometimes heard rumors on the Internet that if you get too much profit, your withdrawal will be denied, but I’ve never heard such rumors about XM.

In fact, if you are a decent trader, you will never be denied a withdrawal for making too much money.

If there is such a thing, it is probably a broker that is struggling with cash flow.

In order to avoid bankruptcy, they need to improve their cash flow (reduce expenses) as much as possible, so they will not want to respond to requests for withdrawals of even higher amounts.

The first thing to do is to avoid using such companies.

So what about XM? Let’s take a closer look.

XM has multiple financial licenses

XM is a global company that provides forex services all over the world, and it has financial licenses in several countries according to their jurisdictions.

XM is licensed by the financial authorities in Seychelles (FSA), Australia (AFSL), Cyprus (CySEC) and so on.

XM segregates client assets

XM segregates client assets.

Segregated management means that the assets deposited by clients are managed in a separate financial institution/account from the company’s operating funds.

Therefore, you can be sure that your deposited funds (margin) will not be used to fund the company’s operations.

XM has been in operation for over 10 years

XM was founded in 2009.

It has been providing forex services worldwide for more than 10 years, and judging from its long track record and scale of operation, it is not a company that is going to run away with its clients’ assets now.

There are more than a hundred forex companies in the world, and since XM is used by so many traders, we can say that XM is reliable.

I’ve heard very few rumors about XM denying withdrawals.

When I search about XM’s withdrawal denial on Twitter and the Internet, I can hardly find any stories about people who have been denied withdrawals.

I tried to search for some keywords on Twitter, but could not find any.

I did find a few posts on Twitter that said they had been denied, but they didn’t say why they were denied or what happened afterwards, so I couldn’t find out the truth.

The financial licenses XM has obtained and the status of customer asset management are described in detail in another article, “XM | Forex Broker Review“. Please refer to this article as well.

Cases of denied withdrawals on XM

However, as mentioned above, there are cases where withdrawal requests are rejected due to rule violations.

Before trading or requesting a withdrawal, check the rules below.

Some people who say they have been denied withdrawals or had their accounts frozen by XM on Twitter, etc., seem to have violated the rules and had their withdrawal requests denied without knowing it.

Are you violating XM withdrawal rules?

The following are XM’s basic withdrawal rules.

First, make sure that you are not making a withdrawal request that violates these.

- Up to the amount of the deposit, the withdrawal method must be the same as when you made the deposit.

- If you have made a deposit using more than one method, the withdrawal methods must be in the same order.

- You must meet the minimum deposit amount.

- Bonuses cannot be withdrawn.

Surprisingly, there are times when people do not understand these rules well and their withdrawal requests are not accept.

If you have deposited with a credit card, you need to withdraw up to the amount of your deposit with the same credit card.

If you have deposited using more than one deposit method, you will need to withdraw the funds in that order and in that amount.

Also, bonuses are not withdrawable. The bonus is credited to your credit line and can be used as margin for trading, but the bonus itself cannot be withdrawn. If you make a withdrawal request for an amount that includes the bonus, you will receive an error message and will not be able to withdraw the money.

XM’s withdrawal rules are summarized in detail in another article, “XM Withdrawal Methods | Rules for withdrawal“. I recommend that you read it once.

Are you violating XM trading rules?

The most common reason for a withdrawal request to be denied is a violation of the rules regarding trading and bonus usage.

The following actions are clear violations of the rules and may result in denial of withdrawal or, in extreme cases, freezing of the account.

- Cross-order trading between multiple accounts in XM

- Cross-order trading using other broker accounts

- Arbitrage across multiple brokers

- Repeatedly obtaining bonuses using other people’s names

What to do if you are denied a withdrawal even though you have not violated any rules

If you have followed the rules and are still denied a withdrawal, contact support immediately.

It is highly recommended that you take a screenshot of your MT4 or MT5 transaction history before contacting them.

If XM decides to freeze your account, you will not be able to login to the XM member page or MT4/MT5. This is also a good evidence to present to support.

For support, live chat is convenient if it is a weekday. You can send an email at any time.

The live chat can be found at the top of XM’s official website, or follow “About Us -> Contact” from the menu.

Summary

What did you think?

XM is a reliable company, and it is unlikely that you will be denied a withdrawal without reason.

If your withdrawal request is not accepted, check for the aforementioned rule violations and contact support first.

Open an Account in XM Now!

You can open an account with XM for free.

The process is very easy.

Take this opportunity to open an account and get XM’s account opening bonus and deposit bonus.

Click the button below to open XM’s official website in a new tab.

Please follow the instructions to open an account.

\Just 3 minutes!!/

Access to XM Official website

Click OPEN AN ACCOUNT on the top page.

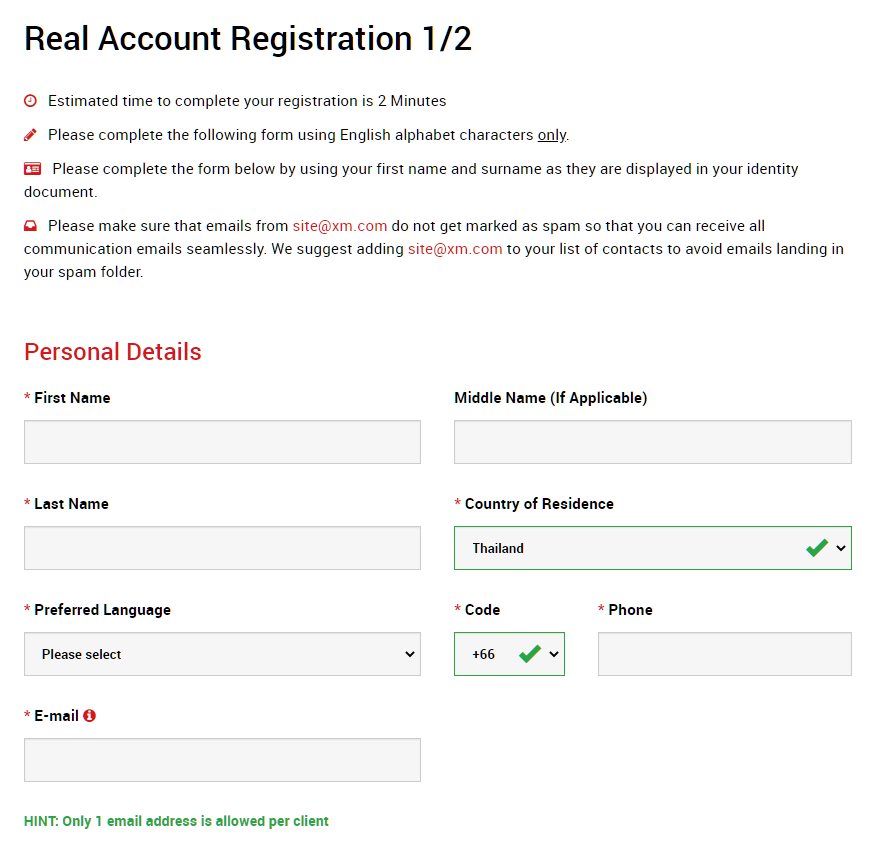

Real Account Registration 1/2

Fill in personal details information.

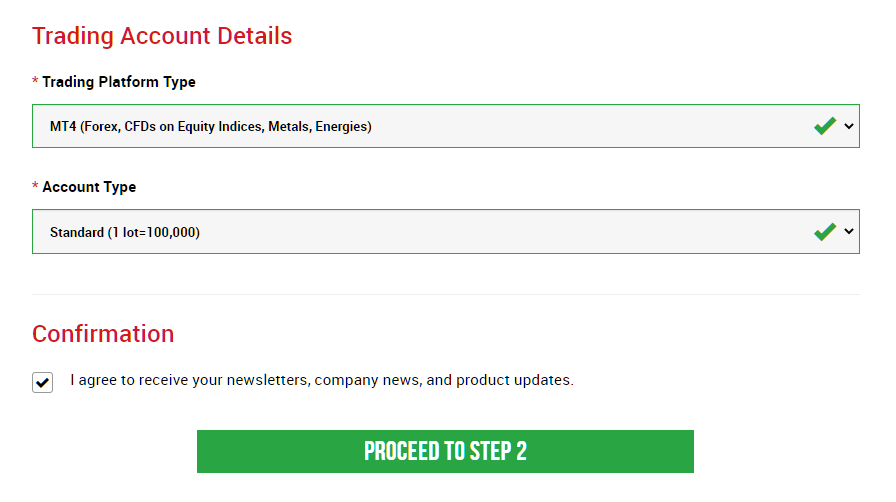

Trading Account Details

Select your trading platform (MT4 or MT5), and

Select your account type.

If you are not sure about the account type, I recommend to select STANDARD account for now.

You will also receive a bonus.

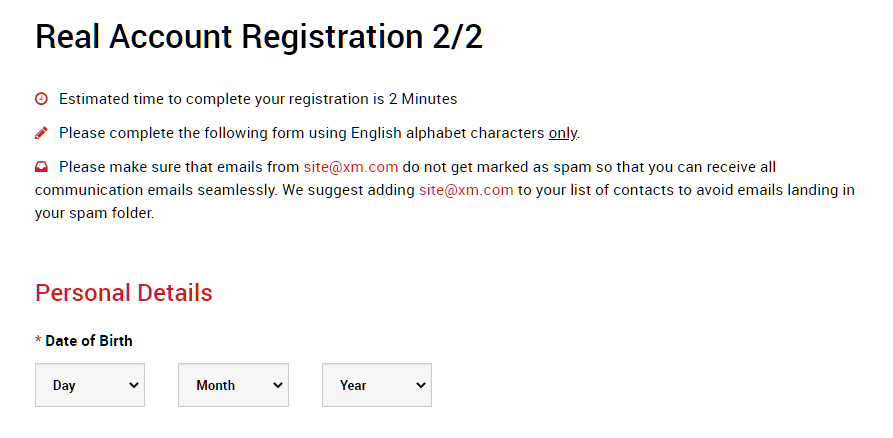

Real Account Registration 2/2

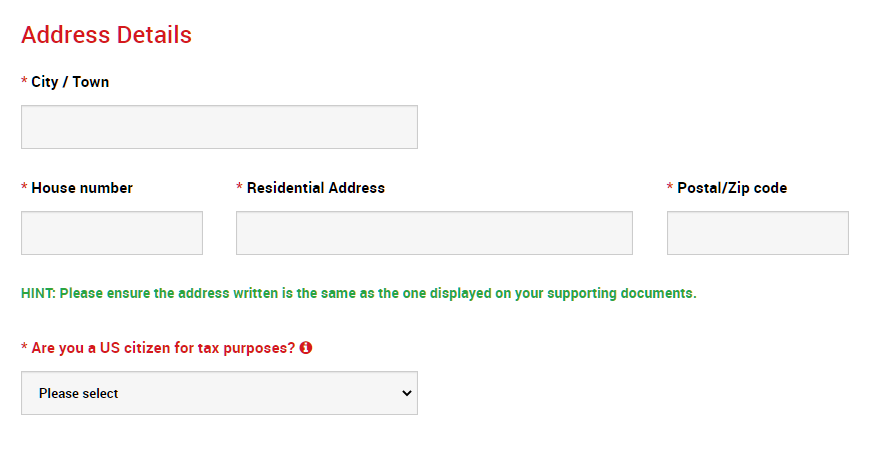

Enter personal infromation.

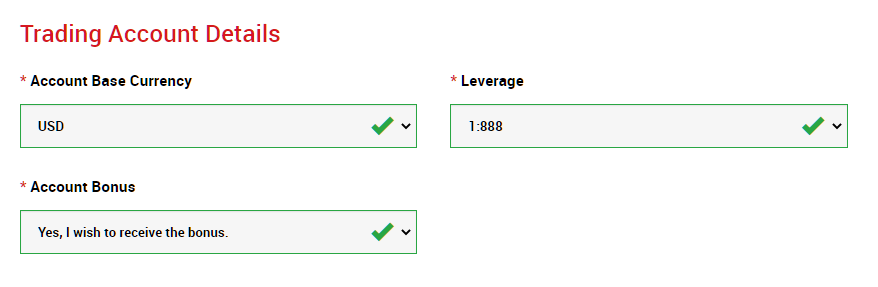

Trading Account Details

Specify the base currency and maximum leverage of your account.

If you want to receive the account opening bonus, please select “Receive” here.

(You can also choose not to receive it.)

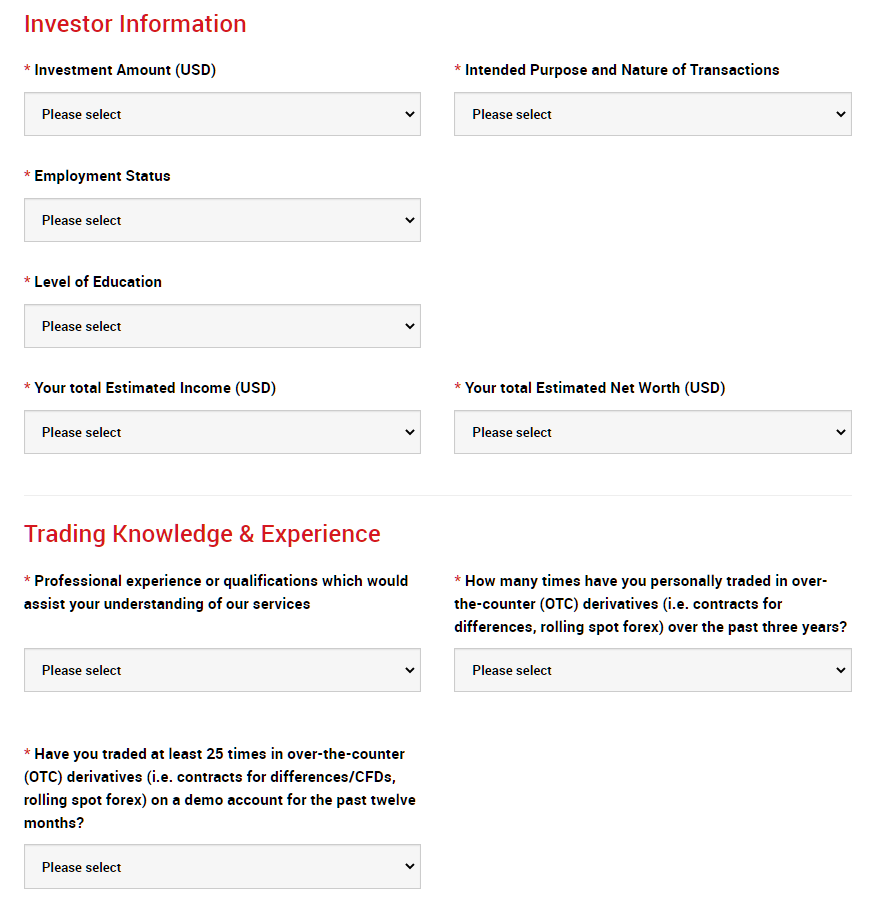

Investor Information

Fill in all area about occupation, investment experience, etc.

This is KYC process that every financial institution must do.

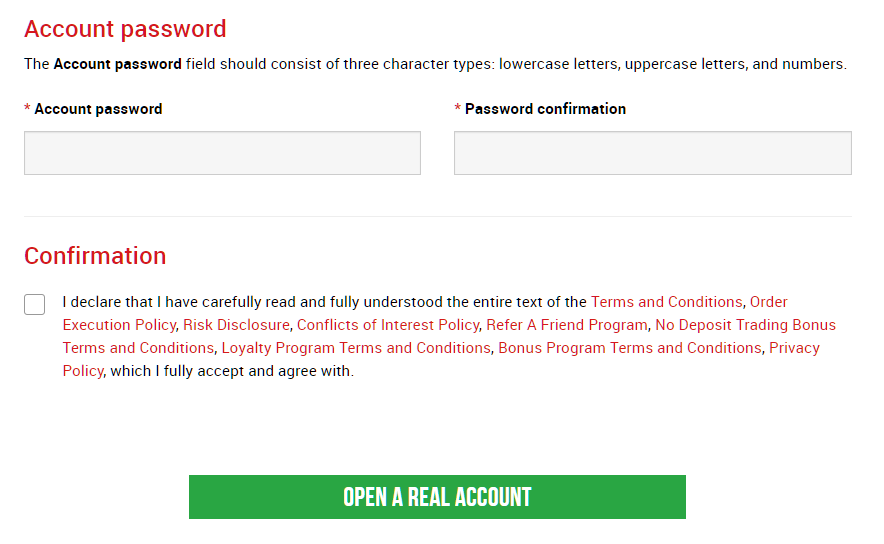

Account Password

Finally, set your password. Use this password to log in to your XM member page or trading account (MT4 or MT5).

Then, authenticate your email address.

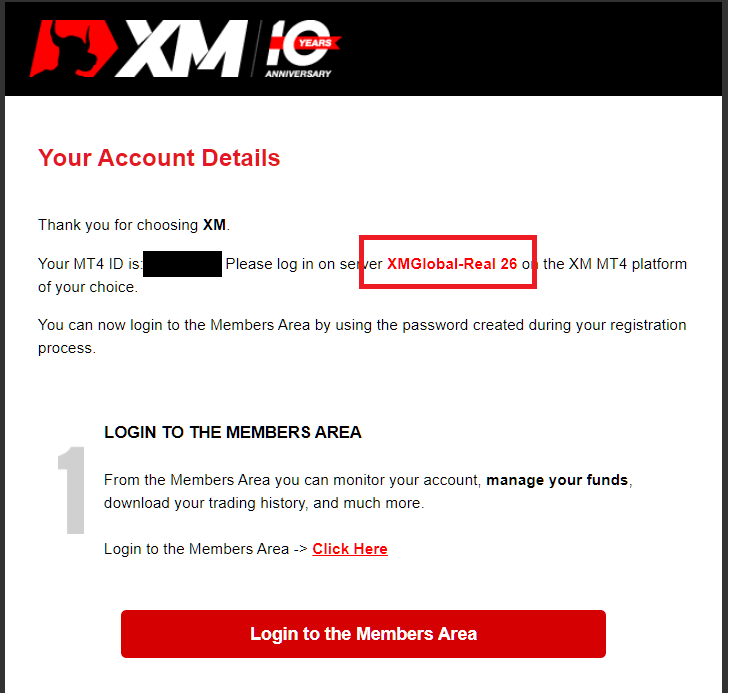

You will then receive an email with your MT4/MT5 account ID and the name of your connection server.

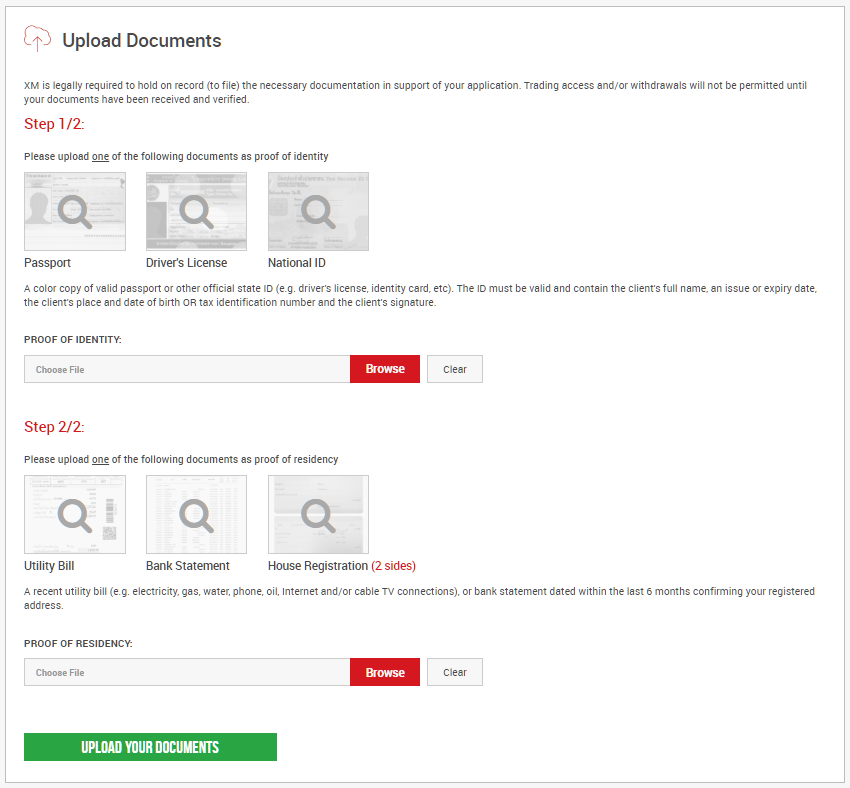

Upload Documents for Identity Verification

Upload your identity verification documents and complete the KYC process.

You can make a deposit and start trading without verifying your identity, but you will need to verify your identity to make a withdrawal.

Claim Trading Bonus

Once the identity verification process is complete, you will see a button to receive the account opening bonus on your member page.

Click on it to receive your account opening bonus.

Install Trading Tool

Install MetaTrader, a trading tool.

The PC version is available from the official XM website.

The smartphone app can be installed from the App Store or Google Play.

For the PC version, please refer to “XM MT4/MT5 | How to Download, Install and Login“.

For the smartphone app version, please refer to “How to Install MT4/MT5 Mobile App“.

Deposit and Trade

Deposit money into your trading account.

The deposit bonus will be transferred to your trading account when it is deposited.

For more information about XM’s deposit methods, please refer to the separate article “XM Deposit Methods | Fees and Conditions“.

Once you deposit, all you have to do is trade.

Take advantage of the account opening bonus and deposit bonus to maximize your profits.

For detailed instructions on how to open an account with XM, please refer to the separate article “XM | How to Open an Account“.

\Just 3 minutes!!/

コメント