I will explain the stop level of Tradeview.

If the stop level is too wide, it will be disadvantageous for traders who aim for profit with small price movements such as scalping.

Stop level is an important factor in forex trading, so please learn about stop level carefully in this article.

- What is Stop level

- Is the Tradeview stop level wide or narrow?

- How to check the stop level of Tradeview

- How about other broker stop levels?

What is Stop Level

The stop level is the minimum from the current price when placing a limit order or stop order, or when setting a stop loss or take profit at the same time as the order.

It is a price range constraint that indicates how far you must be.

For example, suppose you are trading USDJPY and the current price is 105.00.

Assuming that the stop level is 5.0 pips, the take profit setting must be 5.0 pips or higher, that is, 105.051 or higher when placing a buy order.

In other words, you cannot place an order at a price below 105.50.

This is the same to limit / stop limit orders.

The stop level is uniquely defined by each forex broker, it depends on which broker you use.

Should the stop level be wide or narrow?

It is advantageous to have a narrow stop level rather than a wide one.

For example, we may set additional stop loss or take profit settings for an order that has already been entered, or change the settings.

This is the case when you have an unrealized loss, or when the unrealized profit swells and you are confident that the profit will be fixed to some extent.

Especially when you have an unrealized loss and fortunately the price is returning, you can eliminate the loss if you can close at least at the quoted price (entry price), but if the stop level is wide, you have to close position with loss at a distance from the quoted price, or you have to wait until your position turns positive and you have unrealized gains.

The narrower the stop level, the more advantageous it is because it can be set freely.

Is the stop level of Tradeview wide or narrow?

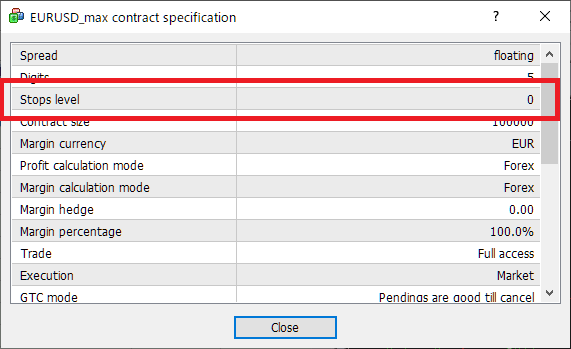

Tradeview’s stop level is very narrow!

Stop levels of all currency pairs and precious metals are zero.

However, since the spread of Tradeview is narrow, it can be said that it is a very advantageous trading condition compared to other forex brokers as a whole.

Major currencies, product stop levels in Tradeview

Since there are spreads in cryptocurrencies and stock indexes, they are also added.

Cryptocurrencies, oils (excluding Crude) and precious metals all have zero stop levels.

Stop levels are set for stock indexes and cryptocurrencies.

Still narrow.

| Symbols | Stop Level |

|---|---|

| EURUSD | 0.0 pips |

| USDJPY | 0.0 pips |

| GBPUSD | 0.0 pips |

| XAUUSD | 0.0 pips |

| CRUDEOIL | 1.0 pips |

| Dow30 | 3.0 pips |

| BTC | 10.0 pips |

How to check stop levels of Tradeview

If you want to check the stop levels just in case, you can check it from the MetaTrader (MT4).

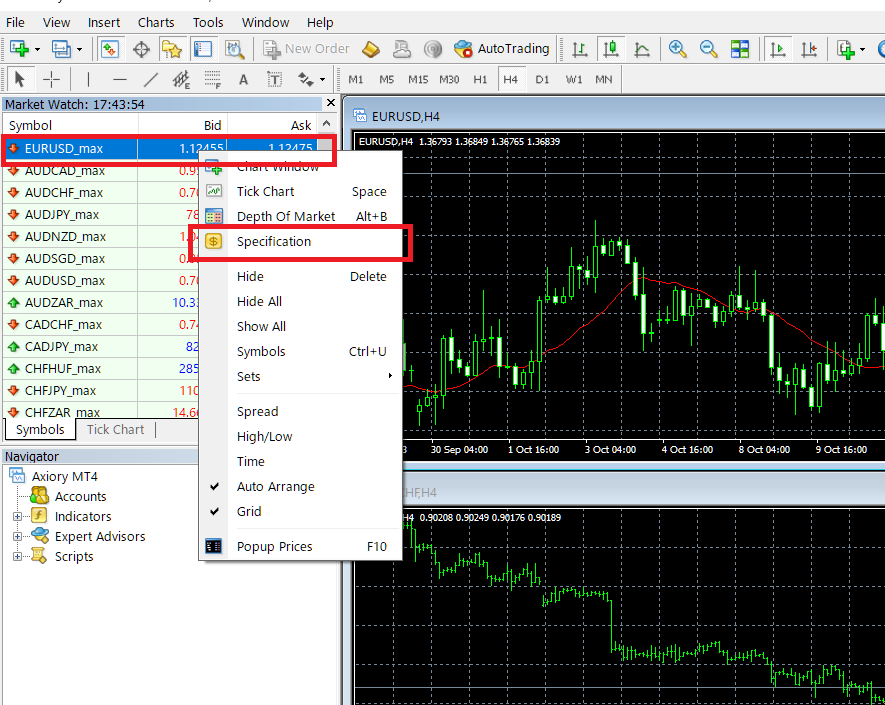

MT4 desktop edition

From the Market Watch area, select the currency pair you want to check the stop level, right-click and select “Specifications”.

You can find “Stops level” in the contract specification window.

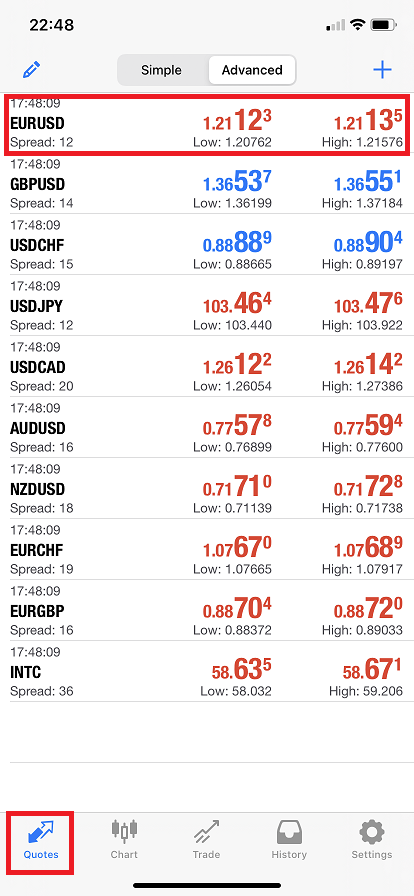

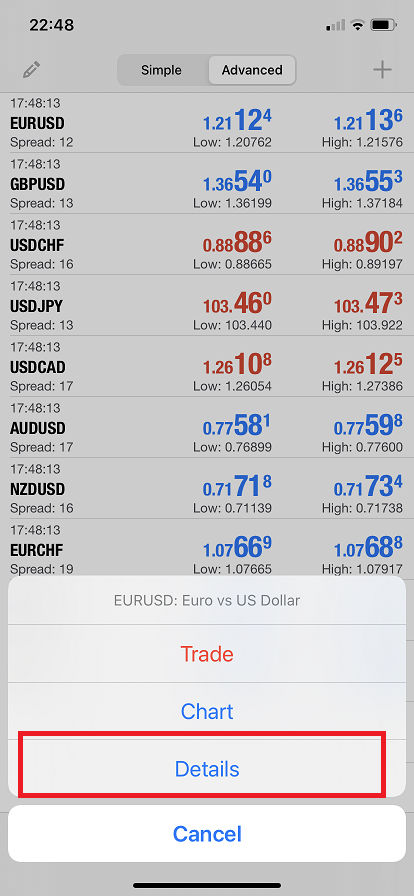

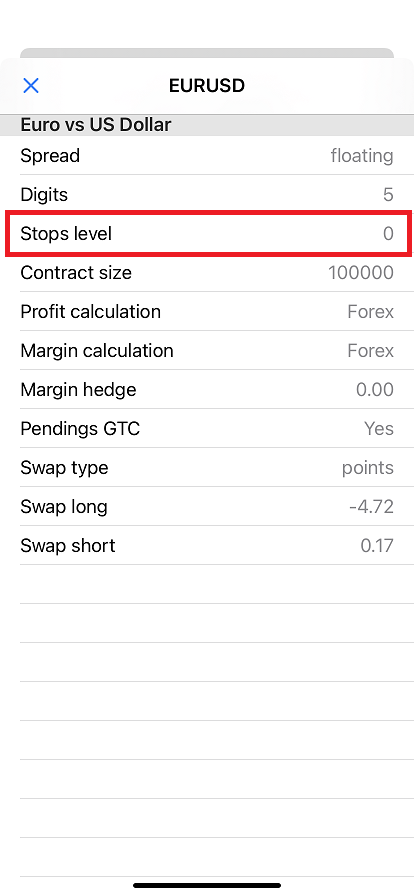

MT4 mobile app

From the Quotes menu, tap the currency pair etc. for which you want to check the stop level and select “Details”.

Are there any other forex brokers offer zero stop level?

Yes, there are other forex brokers offer zero stop level.

The following are forex brokers with zero stop levels or a fairly narrow stop level.

Please note that iFOREX prohibits scalping trading.

| XM | FBS | TitanFX | Axiory | Tradeview | iFOREX | TMGM | |

|---|---|---|---|---|---|---|---|

| Stop Levels | 0.0 pips | 0.1 pips | 0.0 pips | 0.0 pips | 0.0 pips | 0.0 pips | 0.0 pips |

| Scalping | ✔ | ✔ | ✔ | ✔ | ✔ | × | ✔ |

Summary

I explained Tradeview stop levels.

Most of products in Tradeview has a zero stop level for all products, so there are no limits for limit orders.

Also, scalping trading is not prohibited in Tradeview, so make good use of stop level zero and accumulate profits steadily.

\Just 3 minutes!!/

コメント