This is an explanatory article on leverage at FXGT.

At FXGT, a lot of products can be traded with a high leverage of up to 1000 times.

Only FXGT allows you to trade not only currency pairs but also cryptocurrencies such as Bitcoin and Ethereum with a high leverage of 1000x.

However, since cryptocurrencies are highly volatile, while you can aim for large profits with high leverage, there is also the risk of being stop-out in an instant if the market moves in the opposite direction.

To better control such risks, FXGT allows you to change the leverage setting for each account.

In addition, FXGT uses a system called “Dynamic Leverage” that automatically changes leverage in stages depending on trade volume.

In this article, I will explain what leverage is for beginners, the maximum leverage of FXGT, the mechanism of dynamic leverage, how to operate with less risk, and how to change leverage.

- What is the leverage?

- What is the maximum leverage of FXGT?

- What is “Dynamic Leverage” of FXGT?

- How to Change Leverage

What is Leverage?

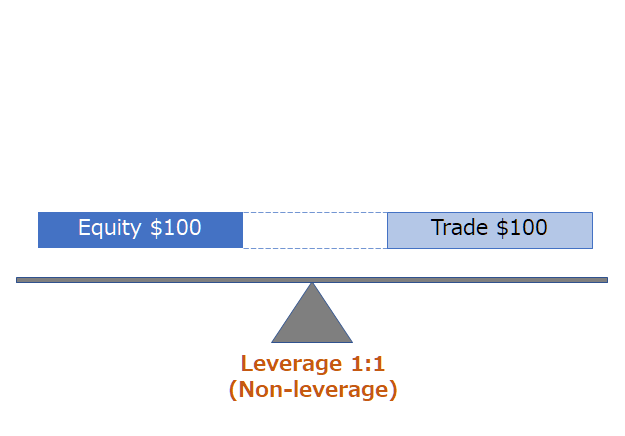

Leverage means the principle of leverage.

Using the principle of leverage, you can lift a large stone with a small power.

In the forex world, it refers to a system that allows you to make large trades with a small amount of margin (money).

Leverage is often expressed as “100 times”, “100x” or “1:100”.

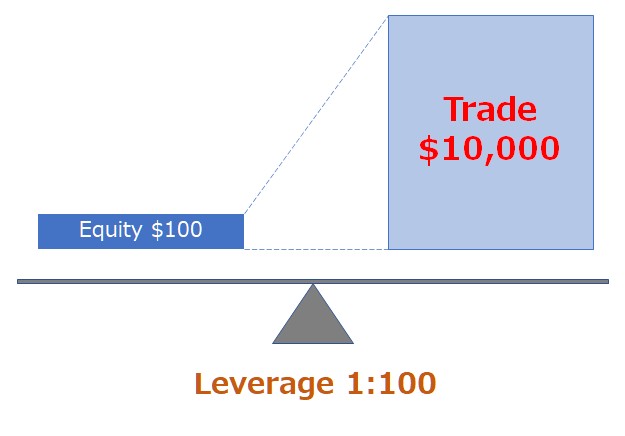

In the case of 100 times leverage, it is possible to trade 100 times the amount of margin.

If your margin is $100, you can trade $10,000.

A $100,000 margin allows you to trade $10,000, and a $100,000 margin allows you to trade $10,000,000.

Differences in Required Margin due to differences in leverage

The Required Margin can be calculated using the following formula

Required Margin = Number of lots × Market price ÷ Leverage

Let’s calculate exactly how much the required margin changes with different leverage.

For example, let’s assume the following trade

Currency pair: EURUSD

Number of trades: 1 lot (=100,000 currency)

Market price: 1 EURO = 1.200 USD

100,000 EUR × 1.200 ÷ 1 = 120,000 USD

100,000 EUR × 1.200 ÷ 100 = 1,200 USD

100,000 EUR × 1.200 ÷ 500 = 240 USD

100,000 EUR × 1.200 ÷ 1000 = 120 USD

Thus, if you take advantage of FXGT maximum 1000x leverage, you can trade 100,000 Euros for only $120.

Trading leverage in FXGT

At FXGT, many products can be traded with a maximum leverage of 1000x.

However, FXGT has the following features

- Adopts “Dynamic Leverage” that changes leverage step by step depending on trading volume

- The volume definition of dynamic leverage varies by product.

Let’s take a closer look at each.

Maximum leverage is the same for all trading instruments

FXGT is a very popular broker because it offers wide range of currency pairs, and many cryptocurrency pairs too.

One of the best features of FXGT is that you can trade with up to 1000x leverage on many stocks.

With other forex brokers, you can trade currency pairs with maximum leverage, but leverage is usually reduced for CFDs such as stock indices, energy, and cryptocurrencies automatically.

At FXGT, however, all products can be traded at a high leverage of 500x.

| Instrument | Max leverage |

|---|---|

| Currency Pair | 1:1000 |

| Stock Index | 1:100 |

| Energy | 1:200 |

| Metal | 1:200 |

| Crypto | 1:1000 |

| Stocks | 1:50 |

All of FXGT products and the maximum leverage that can be traded with each of them are explained in detail in the separate article “FXGT All Products and Trading Conditions | Forex and CFDs“. Please take a look.

Limitation by “Dynamic Leverage”

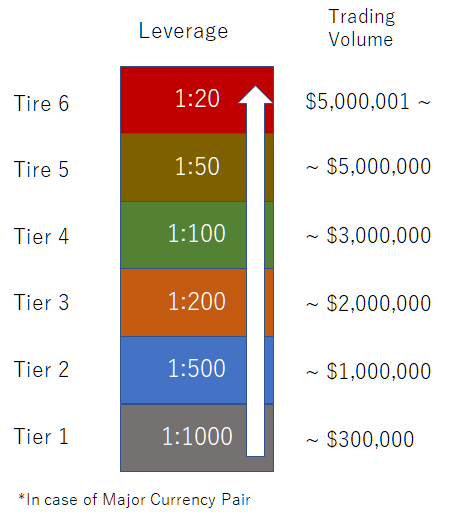

FXGT uses “Dynamic Leverage”.

This is a system in which leverage is limited in stages depending on the volume of trades.

The higher the trade volume, the lower the leverage.

In other words, the system is designed to reduce the risk of loss cutting due to sudden price changes, etc. as much as possible.

How Dynamic Leverage Works

Dynamic leverage works in the following way.

It is divided into six tiers (levels) according to trading volume.

As the trading volume increases, the leverage defined for each tier will be applied.

For example, the following figure shows the dynamic leverage definition for a currency pair, which is calculated as follows

Example: Trading 10 lots of the currency pair EURUSD

(Rate: 1 EUR = 1.21 USD)

Trading volume = 10 lots x 100,000 currencies x 1.21 USD = 1,210,000 USD

→ The first 300,000 USD is 1000x Tier 1 leverage.

The next 700,000 USD is 500x Tier 2 leverage.

The remaining 210,000 USD will be leveraged by Tier 3 at 200x.

Required margin:

Tier 1: 300,000 USD ÷ 1000x = 300 USD

Tier 2: 700,000 USD ÷ 500x = 1,400 USD

Tier 3: 210,000 USD ÷ 200x = 1,050 USD

Total margin requirement = 300 + 1,400 + 1,050 = 2,750 USD

Dynamic leverage is defined in different tiers for different products, as explained in the next section.

For a currency pair, you can trade with 1000x leverage as long as you do not make large trades such as 10 lots as in the example above.

Definition of dynamic leverage by product

The following is a definition of dynamic leverage for each product.

Currency Pair

The dynamic leverage of a currency pair depends on the type of currency pair.

Major Currency Pair

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 300,000 | 1:1000 | 0.1% |

| Tier 2 | > 300,000 – 1,000,000 | 1:500 | 0.2% |

| Tier 3 | > 1,000,000 – 2,000,000 | 1:200 | 0.5% |

| Tier 4 | > 2,000,000 – 3,000,000 | 1:100 | 1% |

| Tier 5 | > 3,000,000 – 5,000,000 | 1:50 | 2% |

| Tier 6 | >5,000,000 | 1:20 | 5% |

Cross Currency Pair

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 200,000 | 1:1000 | 0.1% |

| Tier 2 | > 200,000 – 500,000 | 1:500 | 0.2% |

| Tier 3 | > 500,000 – 1,000,000 | 1:200 | 0.5% |

| Tier 4 | > 1,000,000 – 2,000,000 | 1:100 | 1% |

| Tier 5 | > 2,000,000 – 3,000,000 | 1:50 | 2% |

| Tier 6 | > 3,000,000 | 1:20 | 5% |

Exotic Currency Pair

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 200,000 | 1:500 | 0.2% |

| Tier 2 | > 200,000 – 500,000 | 1:200 | 0.5% |

| Tier 3 | > 500,000 – 1,000,000 | 1:100 | 1% |

| Tier 4 | > 1,000,000 – 3,000,000 | 1:50 | 2% |

| Tier 5 | > 3,000,000 | 1:20 | 5% |

Cryptocurrency

The leverage definition of cryptocurrency varies depending on the coin.

Bitcoin(BTC), Litecoin(LTC), Ethereun(ETH), Bitcoin Cash(BCH), Ripple(XRP)

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 3,000 | 1:1000 | 0.1% |

| Tier 2 | > 3,000 – 10,000 | 1:500 | 0.2% |

| Tier 3 | > 10,000 – 50,000 | 1:200 | 0.5% |

| Tier 4 | > 50,000 – 100,000 | 1:100 | 1% |

| Tier 5 | > 100,000 – 200,000 | 1:50 | 2% |

| Tier 6 | > 200,000 | 1:20 | 5% |

Ada (ADA), Polka Dot (DOT), and Stellar Lumen (XLM)

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 3,000 | 1:1000 | 0.1% |

| Tier 2 | > 3,000 – 10,000 | 1:500 | 0.2% |

| Tier 3 | > 10,000 – 20,000 | 1:200 | 0.5% |

| Tier 4 | > 20,000 – 60,000 | 1:100 | 1% |

| Tier 5 | > 60,000 – 80,000 | 1:50 | 2% |

| Tier 6 | > 80,000 | 1:20 | 5% |

Metal

Definition of Metal

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 200,000 | 1:200 | 0.5% |

| Tier 2 | > 200,000 – 1,000,000 | 1:100 | 1% |

| Tier 3 | > 1,000,000 – 5,000,000 | 1:60 | 1.67% |

| Tier 4 | > 5,000,000 – 7,000,000 | 1:40 | 2.5% |

| Tier 5 | > 7,000,000 | 1:20 | 5% |

Energy

Definition of Energy.

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 200,000 | 1:100 | 1% |

| Tier 2 | 200,000 – 1,000,000 | 1:50 | 2% |

| Tier 3 | 1,000,000 – 5,000,000 | 1:30 | 3.33% |

| Tier 4 | 5,000,000 – 7,000,000 | 1:20 | 5% |

| Tier 5 | >7,000,000 | 1:10 | 10% |

Stock Index

Definition of Stock Index.

| Tiers | Volume (USD) | Leverage | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 200,000 | 1:100 | 1% |

| Tier 2 | > 200,000 – 500,000 | 1:50 | 2% |

| Tier 3 | > 500,000 – 5,000,000 | 1:30 | 3.33% |

| Tier 4 | > 5,000,000 – 7,000,000 | 1:20 | 5% |

| Tier 5 | >7,000,000 | 1:10 | 10% |

Stocks

Definition of individual stock.

*It is important to note that FXGT’s leverage on individual stocks is limited to 10x for stock positions ordered between 21:59 and 22:59 (GMT+3), regardless of trading volume.

Everything outside this time period will be calculated according to the definitions in the table below.

| Tiers | Volume (USD) | Leverage* | Margin % |

|---|---|---|---|

| Tier 1 | 0 – 10,000 | 1:50 | 2% |

| Tier 2 | 10,000 – 50,000 | 1:25 | 4% |

| Tier 3 | 50,000 – 200,000 | 1:15 | 6.67% |

| Tier 4 | 200,000 – 1,000,000 | 1:10 | 10% |

| Tier 5 | >1,000,000 | 1:5 | 20% |

Recommended operation

Especially in the world of forex, people focus on the high leverage, but the higher leverage is not the better.

Leverage is a double-edged sword.

If you trade a product with high volatility with full leverage, a small price reversal will result in an immediate loss.

This is not a recommendation, but rather a principle of leveraged trading.

- Follow strictly the money management rules

- Understand the margin requirements and the amount per pips

- Adjust the number of lots and leverage

When you increase the leverage, the amount of fluctuation per pips becomes larger.

It is necessary to decide beforehand how much you can bear in case the price moves against your expectations. After properly planning your trading strategy, prepare sufficient funds and decide on the number of lots to order.

At this time, you can also change the leverage in advance to reduce the risk of loss cutting in case of unexpected price movements.

This means that rather than operating with 1000 times leverage, you can reduce the risk to one tenth by using 100 times leverage.

How to Change Leverage at FXGT

The leverage of FXGT can be changed for each account.

Since it can be changed for each account, you can create additional accounts, change the trading instruments for each account, and reduce the leverage for the account with the highest volatility to reduce the risk.

The leverage of FXGT can be changed by following the steps below.

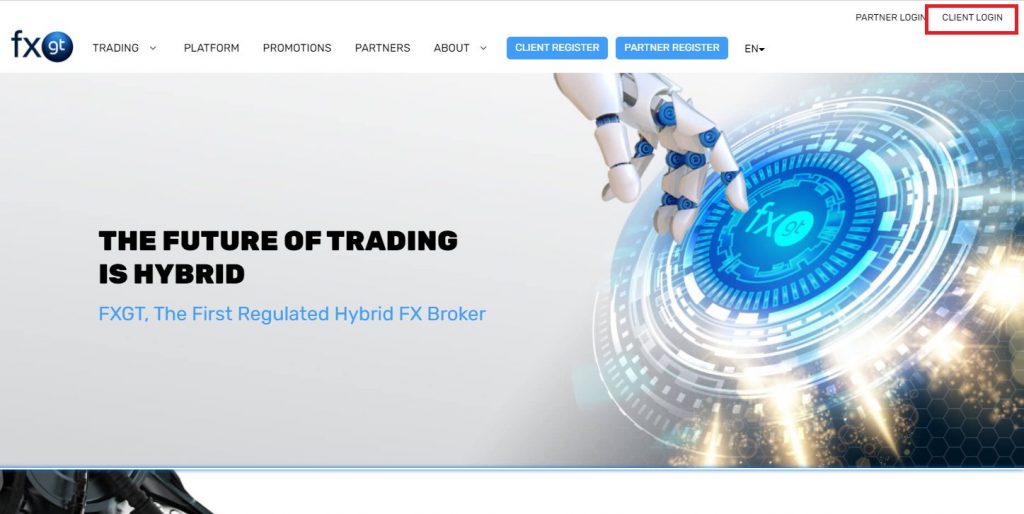

Login to Client Portal

Login to Client Portal from the top page of FXGT official site.

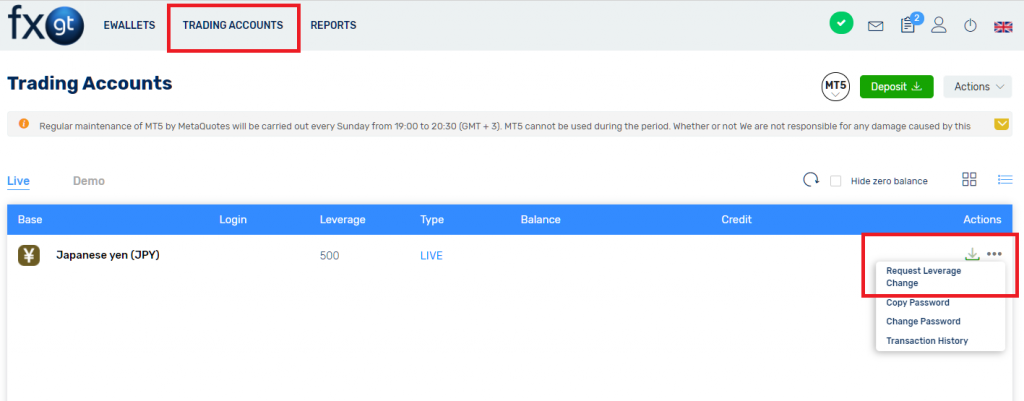

Select target account

From the list of trading accounts, select “Request Leverage Change” for the account you want to change the leverage of.

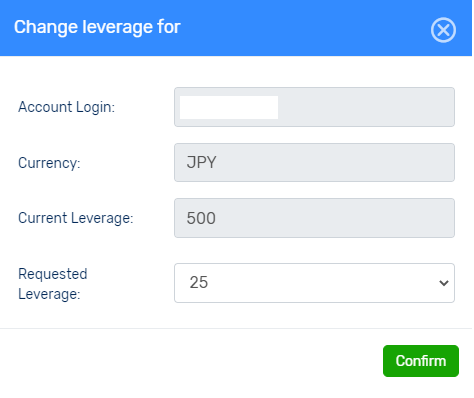

Change leverage

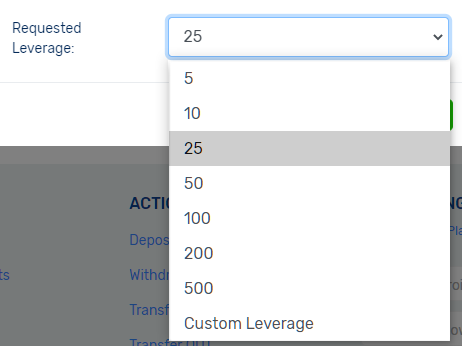

select the leverage you want to change.

Here, I will change it from 500x to 25x to reduce the risk.

You can choose from a list of commonly set leverage values, but if you select “Custom Leverage,” you can set the leverage you want in increments of one.

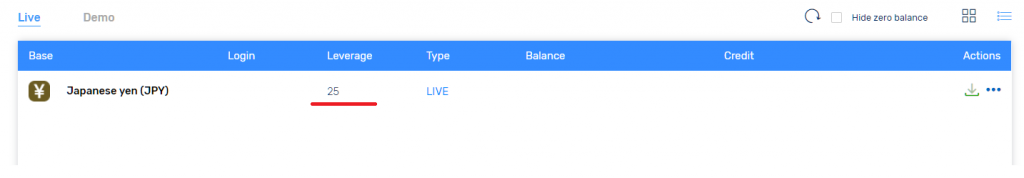

Change leverage complete

The change in leverage will be reflected immediately.

For more information on how to create an additional account at FXGT and how to operate with less risk by utilizing multiple accounts, please refer to the separate article “How to Open FXGT Additional Account | How to Reduce Risks“.

\Just 1 minutes!!/

Summary

What did you think?

At FXGT, a lot of products can be traded with a high leverage of up to 1000x.

However, due to the dynamic leverage mechanism, the leverage is limited in stages depending on the trade volume.

It is also possible to take advantage of the characteristics of leverage to make larger profits or trade with less risk.

Please make sure you understand leverage and use the leverage change function to manage your trading safely.

\Just 3 minutes!!/

コメント