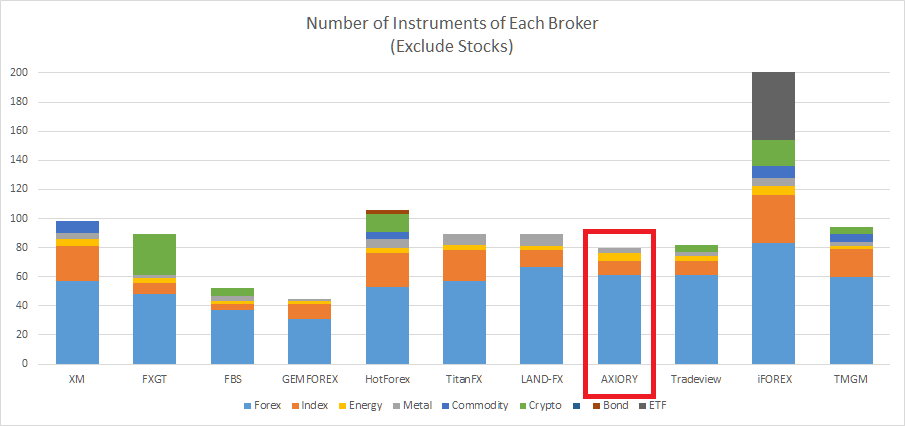

As explained in the article “Forex Broker Products Comparison Review“, each forex broker offers very attractive products.

Among the currency pairs that can be traded with high leverage, there are a variety of major currency pairs and exotic currencies.

CFDs include global stock indexes, futures products such as crude oil and commodities, and the popular gold.

There are also some brokers that handle cryptocurrencies, individual stocks, ETFs and bonds.

In this article, I will thoroughly explain the products handled by Axiory, which is very popular due to its low fees and detailed support, and the terms and conditions of each transaction.

Axiory All Products

Axiory handles the following products.

Axiory handles 158 brands in total.

| Total | Currency | Index | Energy | Metal | Commodity | Crypto | Stocks | Bond | ETF | |

|---|---|---|---|---|---|---|---|---|---|---|

| Axiory | 158 | 61 | 10 | 5 | 4 | – | – | 78 | – | – |

From here, I will introduce all the stocks handled by Axiory and the maximum leverage that can be traded by each.

Please check the official website for more detailed conditions.

Axiory Currency Pair, All Symbol and Max Leverage

Axiory handles 61 symbols of currency pair.

It’s larger number than other brokers.

| Symbol | Product | Max Leverage |

|---|---|---|

| USDJPY | US Dollar / Japanese Yen | 1:400 |

| EURJPY | Euro / Japanese Yen | 1:400 |

| GBPJPY | Sterling Pound / Japanese Yen | 1:400 |

| AUDJPY | Australian Dollar / Japanese Yen | 1:400 |

| NZDJPY | NZ Dollar / Japanese Yen | 1:400 |

| EURUSD | Euro / US Dollar | 1:400 |

| AUDCAD | Australian Dollar / Canadian Dollar | 1:400 |

| AUDCHF | Australian Dollar / Swiss Franc | 1:400 |

| AUDNZD | Australian Dollar / NZ Dollar | 1:400 |

| AUDSGD | Canadian Dollar / Singapore Dollar | 1:400 |

| AUDUSD | Australian Dollar / US Dollar | 1:400 |

| AUDZAR | Australian Dollar / South African Rand | 1:400 |

| CADCHF | Canadian Dollar / Swiss Franc | 1:400 |

| CADJPY | Canadian Dollar / Japanese Yen | 1:400 |

| CHFHUF | Swiss Franc / Hungarian Forint | 1:400 |

| CHFJPY | Swiss Franc / Japanese Yen | 1:400 |

| CHFZAR | Swiss Franc / South African Rand | 1:400 |

| EURAUD | Euro / Australian Dollar | 1:400 |

| EURCAD | Euro / Canadian Dollar | 1:400 |

| EURCHF | Euro / Swiss Franc | 1:400 |

| EURCZK | Euro / Czech Koruna | 1:400 |

| EURGBP | Euro / Sterling Pound | 1:400 |

| EURHUF | Euro / Hungary Forint | 1:400 |

| EURMXN | Euro / Mexican Peso | 1:400 |

| EURNOK | Euro / Norwegian Krone | 1:400 |

| EURNZD | Euro / NZ Dollar | 1:400 |

| EURPLN | Euro / Polish Zloty | 1:400 |

| EURRUB | Euro / Russian Ruble | 1:400 |

| EURSEK | Euro / Swedish Krona | 1:400 |

| EURSGD | Euro / Singapore Dollar | 1:400 |

| EURTRY | Euro / Turkish Lira | 1:400 |

| EURZAR | Euro / South African Rand | 1:400 |

| GBPAUD | Sterling Pound / Australian Dollar | 1:400 |

| GBPCAD | Sterling Pound / Canadian Dollar | 1:400 |

| GBPCHF | Sterling Pound / Swiss Franc | 1:400 |

| GBPNZD | Sterling Pound / NZ Dollar | 1:400 |

| GBPSGD | Sterling Pound / Singapore Dollar | 1:400 |

| GBPUSD | Sterling Pound / US Dollar | 1:400 |

| GBPZAR | Sterling Pound / South African Rand | 1:400 |

| NOKSEK | Norwegian Krone / Swedish Krona | 1:400 |

| NZDCAD | NZ Dollar / Canadian Dollar | 1:400 |

| NZDCHF | NZ Dollar / Swiss Franc | 1:400 |

| NZDSEK | NZ Dollar / Swedish Krona | 1:400 |

| NZDSGD | NZ Dollar / Singapore Dollar | 1:400 |

| NZDUSD | NZ Dollar / US Dollar | 1:400 |

| SGDJPY | Singapore Dollar / Japanese Yen | 1:400 |

| TRYJPY | Turkish Lira / Japanese Yen | 1:400 |

| USDCAD | US Dollar / Canadian Dollar | 1:400 |

| USDCHF | US Dollar / Swiss Franc | 1:400 |

| USDCZK | US Dollar / Czech Koruna | 1:400 |

| USDHUF | US Dollar / Hungarian Forint | 1:400 |

| USDILS | US Dollar / Israeli New Shekel | 1:400 |

| USDMXN | US Dollar / Mexican Peso | 1:400 |

| USDNOK | US Dollar / Norwegian Krone | 1:400 |

| USDPLN | US Dollar Polish Zloty | 1:400 |

| USDRUB | US Dollar / Russian Ruble | 1:400 |

| USDSEK | US Dollar / Swedish Krona | 1:400 |

| USDSGD | US Dollar / Singapore Dollar | 1:400 |

| USDTRY | US Dollar / Turkish Lira | 1:400 |

| USDZAR | US Dollar / South African Rand | 1:400 |

| ZARJPY | South African Rand / Japanese Yen | 1:400 |

Axiory Index, All Symbol and Max Leverage

Axiory handles 10 symbols of index.

You can trade indexes on the world’s major stock markets.

Only Germany and Hong Kong can be traded with a leverage of 1:50 , and the others with a leverage of 1:100.

| Symbol | Product | Max leverage |

|---|---|---|

| NIKKEI | Nikkei 225 Stock Index | 1:100 |

| DOW | NY Dow Jones Industrial Average | 1:100 |

| NSDQ | NASDAQ Stock Index | 1:100 |

| SP | S&P 500 Stock Index | 1:100 |

| FTSE | London Stock Index | 1:100 |

| STOXX50 | Euro Stocks 50 Index | 1:100 |

| DAX | German Stock Index | 1:50 |

| CAC | France Stock Index | 1:100 |

| ASX | Australian Stock Index | 1:100 |

| HK50 | Hong Kong 50 Index | 1:50 |

Axiory Energy, All Symbol and Max Leverage

Axiory handles 5 symbols of energy.

Axiory also handles WTI and Brent index products.

| Symbol | Products | Max Leverage |

|---|---|---|

| CL | US Crude Oil | 1:20 |

| CL.i | US Crude Oil Index | 1:20 |

| BRENT | UK Brent Oil | 1:20 |

| BRENT.i | UK Brent Oil Index | 1:20 |

| NGAS | Natural Gas | 1:20 |

Axiory Metal, All Symbol and Max Leverage

Axiory handles 4 symbols of metal.

| Symbol | Product | Max Leverage |

|---|---|---|

| XAUUSD | GOLD / USD | 1:100 |

| XAGUSD | SILVER / USD | 1:100 |

| XPDUSD | Palladium | 1:20 |

| XPTUSD | Platinum | 1:20 |

Axiory Stocks, All Symbol and Max Leverage

Axiory handles 78 symbols of stocks.

Axiory has started handling US stock CFDs in November 2020.

It is said that Axiory will continue to increase the number of brands in the future.

In any symbols, the maximum leverage is 1:5.

| Product (Symbol) | Max Leverage |

|---|---|

| Apple (AAPL) | 1:5 |

| Adobe (ADBE) | 1:5 |

| Autodesk (ADSK) | 1:5 |

| American International Group (AIG) | 1:5 |

| Advanced Micro Devices (AMD) | 1:5 |

| Amazon.com (AMZN) | 1:5 |

| Activision Blizzard (ATVI) | 1:5 |

| Broadcom (AVGO) | 1:5 |

| American Express Company (AXP) | 1:5 |

| Boeing Company (BA) | 1:5 |

| Alibaba Group Holding (BABA) | 1:5 |

| Bank of America Corp (BAC) | 1:5 |

| Booking Holdings (BKNG) | 1:5 |

| Blackrock (BLK) | 1:5 |

| Berkshire Hathaway class B (BRK.B) | 1:5 |

| Citigroup (C) | 1:5 |

| Caterpillar (CAT) | 1:5 |

| CME Group (CME) | 1:5 |

| Costco Wholesale Corp (COST) | 1:5 |

| Salesforce.com (CRM) | 1:5 |

| Cisco Systems (CSCO) | 1:5 |

| Chevron Corp (CVX) | 1:5 |

| Walt Disney Company (DIS) | 1:5 |

| eBay (EBAY) | 1:5 |

| Equinix (EQIX) | 1:5 |

| Ford Motor Company (F) | 1:5 |

| Facebook (FB) | 1:5 |

| FedEx Corp (FDX) | 1:5 |

| General Electric Company (GE) | 1:5 |

| General Mills (GIS) | 1:5 |

| General Motors Company (GM) | 1:5 |

| Alphabet (GOOGL) | 1:5 |

| Garmin Ltd (GRMN) | 1:5 |

| Goldman Sachs Group (GS) | 1:5 |

| Home Depot (HD) | 1:5 |

| Hilton Worldwide Holdings (HLT) | 1:5 |

| Honeywell International (HON) | 1:5 |

| HP (HPQ) | 1:5 |

| International Business Machines Corp (IBM) | 1:5 |

| Intel Corp (INTC) | 1:5 |

| Johnson & Johnson (JNJ) | 1:5 |

| JPMorgan Chase & Co (JPM) | 1:5 |

| Coca-Cola Company (KO) | 1:5 |

| Lockheed Martin Corp (LMT) | 1:5 |

| Mastercard (MA) | 1:5 |

| McDonald”s Corp (MCD) | 1:5 |

| Moody’s Corp (MCO) | 1:5 |

| Mondelez International (MDLZ) | 1:5 |

| 3M Company (MMM) | 1:5 |

| Microsoft Corp (MSFT) | 1:5 |

| Micron Technology (MU) | 1:5 |

| Netflix (NFLX) | 1:5 |

| Nike (NKE) | 1:5 |

| NVIDIA Corp (NVDA) | 1:5 |

| Oracle Corp (ORCL) | 1:5 |

| PepsiCo (PEP) | 1:5 |

| Pfizer (PFE) | 1:5 |

| Procter & Gamble Company (PG) | 1:5 |

| Philip Morris International (PM) | 1:5 |

| Prudential Financial (PRU) | 1:5 |

| PayPal Holdings (PYPL) | 1:5 |

| Qualcomm (QCOM) | 1:5 |

| Starbucks Corp (SBUX) | 1:5 |

| Schlumberger Limited (SLB) | 1:5 |

| AT&T (T) | 1:5 |

| Teva Pharmaceutical Industries Limited (TEVA) | 1:5 |

| Target Corp (TGT) | 1:5 |

| T-Mobile US (TMUS) | 1:5 |

| Tractor Supply Company (TSCO) | 1:5 |

| Tesla (TSLA) | 1:5 |

| Twitter (TWTR) | 1:5 |

| Raytheon Technologies Corp (RTX) | 1:5 |

| VISA (V) | 1:5 |

| Verizon Communications (VZ) | 1:5 |

| Western Digital Corp (WDC) | 1:5 |

| Wells Fargo & Co (WFC) | 1:5 |

| Walmart (WMT) | 1:5 |

| Exxon Mobil Corp (XOM) | 1:5 |

How is Axiory evaluated compared to other brokers?

Although the number of products handled by Axiory was at a normal level before, Axiory started handling CFDs for US stocks in November 2020, it makes Axiory a very attractive broker.

Currently, the only individual stocks are US stocks, but it is said that stocks from other countries will be added in the future. It seems to become more and more popular.

What about the products handled by other forex brokers?

Please see the separate article “Forex Broker Products Comparison Review“.

I introduce all the products handled by forex brokers that I introduce.

It also explains the features of each product, so if you are a beginner, please take a look there first.

\Just 3 minutes!!/

コメント