So far, I have explained what forex brokers are, a list of forex brokers that I recommend, and so on.

If you read these articles, I think that you can roughly understand are the advantages and disadvantages of each forex brokers.

In the last, I would like to introduce a broker for beginners that I recommend.

The Forex brokers I am introducing are reliable brokers because they have financial license and disclose a lot of information on their own website.

On the other hand, some forex beginners are attracted to forex and although it seems trustworthy, but I think you have no idea which broker is suitable for you.

I think some people may be wondering what criteria to choose.

So, in this article, I will explain in detail how to choose forex brokers from my point of view as a trader who actually uses these brokers, and how each broker is actually evaluated with each criteria.

Let’s get started!

- Features of Forex Broker

- Advantage, Disadvantage

- My Recommend Investment Method – Diversified Funds

- What kind of trading style suitable for?

- How to Choose the Best Broker

- Recommended Broker for Beginners

- The Best Broker for Beginners 1st : XM

- The Best Broker for Beginners 2nd : HotForex

- The Best Broker for Beginners 3rd : FXGT

- The Best Broker for Beginners 4th : FBS

- The Best Broker for Beginners 5th : Axiory

- The Best Broker for Beginners 6th : LAND-FX

- The Best Broker for Beginners 7th : TitanFX

- The Best Broker for Beginners 8th : Tradeview

- The Best Broker for Beginners 9th : TMGM(TradeMax)

- The Best Broker for Beginners 10th : iFOREX

- Summary

Features of Forex Broker

First of all, let’s review.

As explained in past articles, the following are the characteristics of forex brokers.

- High Leverage

- Negative Balance protection

- Bonus Programs

*Main specifications

| Forex Brokers | |

| Trading Method | NDD |

| Spreads | STP : Wider ECN : Narrow |

| Trading Platfform | Basically, MT4/MT5 |

| Max Leverage | 1:400~1:3000 |

| Negative Balance Protection | ✔ |

| Regulated | Each Countries |

| Funding Method | Many |

Advantage, Disadvantage

Basically, followings are advantage and disadvantage.

- Can aim for big profits with a small amount of funds with high leverage trading

- Stop out standard is low, can put up with it until the margin is low

- No debt due to negative balance protection

- Gorgeous bonus programs (*depends on broker)

- Wide spreads (STP account type)

The biggest merit is that high leverage trading.

Anyway, you can aim for big profit with a small amount of money.

1:400 to 1:500 is normal, there are also 1:1000!

In addition, with the negtive balance protection system, even if you encounter a stop out and the margin becomes negative, the negative amount will be compensated by the broker and you do not need to deposit.

In addition, some forex broker has bonus programs, you can get funds that can be used for trading just by opening an account, or by deposit the funds will be increased according to the deposit amount.

This is also one of the means to aim for greater profits.

My Recommend Investment Method – Diversified Funds

My recommended investment method is to trade without putting too much money in one account.

For that purpose, one of the means is to operate in multiple accounts (with the same broker) or diversified to multiple brokers.

For example, if you put $ 100,000 in one account and trade in a large lot, you will get a huge profit because it is high leverage (hopefully it will be a moment to double the balance. It is not a dream.), but vice versa.

Also, when you lose it, it will be very quick.

Therefore, I strongly recommend that you use a small amount of money, such as $ 10,000 at most.

I recommend that you manage at least 2 accounts, and if it is not troublesome, divide it into 4 to 5 accounts.

If you have $ 5,000, you can split it into two accounts of $ 2,500 each.

Also, please control your account balance well by withdrawing profits frequently.

If you are using a broker it allows multiple accounts, you can easily and instantly transfer funds between accounts from the website.

Even if you don’t withdraw the profits to your bank account, you can create one account for the profit pool and move it there.

For example, create three accounts, account A, account B, and account C.

Deposit $ 1,000 each to account A and account B, and use them properly, such as trading with different currency pairs and different leverage.

If you could make a profit, transfer the profit to the account C.

In this way, even if the position of account A suddenly moves and you encounter a stop out, it will not affect the funds of account B, and if you’ve transferred profits to account C, it will not affect it either.

Transfer funds from account B or account C to A account, and calmly resume trading.

In this way, I think that every trader is devising how to operate with reduced risk while taking advantage of the characteristics of these forex traders.

In fact, I always have 4-5 accounts with funds.

What kind of trading style suitable for?

In my opinion, by controlling the leverage and the number of lots to trade, you can adapt to different trading styles.

*Of course, it depends on your capital.

Low Leverage :

- Long term trading

- Accumulate small profits with lower risk

High leverage :

- Mid ~ Short term trading

- Aim for big profits with high leverage

Long-term trading has two meanings.

A type that waits until the value of the currency rises / falls significantly, and a type that aims for daily swap points by holding for a long time.

The former is similar to holding a stock.

You may not have heard of the latter swap point. Simply say, when you trade between currencies with large policy interest rate differentials in each country, you get daily money called swaps, which is calculated based on the interest rate differentials, while you hold a position.

Turkey (Lira), Mexico (Peso) and South Africa (Rand) are famous countries with high policy interest rates.

Swap points are generated when you purchase these currencies using major currencies such as USD and Euro.

In fact, long-term holdings with high leverage are too risky. Imagine, it’s scary to own a Turkish lira for years …

Forex traders can set the leverage by themselves, so it is possible to set it to a low leverage and trade for a long time, if you want.

It is often said that forex is a risky, but for traders who accumulate profits in the short term, they can aim for large profits in the short term with a small amount of funds, so it can be said that there is a big advantage.

Again, you can trade with high leverage, but you can make it lower leverage depending on your settings.

In addition, the minimum trade is from 0.01 lot, and most traders can create multiple accounts, so as I mentioned above, by diversifying funds and operating with multiple accounts, it is possible to trade with reduced risk.

- High leverage is suitable for traders who make profits in medium to short term.

- Long-term holding is also possible. In that case, take measures such as lower leverage and distributing accounts.

How to Choose the Best Broker

Okay, let’s choose now.

From my point of view, I think that the following items should be evaluated, and I do so myself.

In each evaluation item, please select a trader based on your trading style, evaluation criteria, and preferences.

- Is it a reliable?

- What is the maximum leverage?

- Is a negative balance protection system adopted?

- Is there a product you want to trade?

- Are the fees low?

- What can you select as account currency?

- Is the funding method convenient?

- Is there a bonus program?

- Is there enough support?

After explaining each evaluation item, I explain in detail about each broker.

Let’s look at them in order.

① Reliable

Is that broker reliable?

There are two perspectives.

First, does that broker have a financial license?

Second, is there any measure to protect customer assets?

As for financial licenses, all the companies I refer to have. They have obtained it in various countries, there are differences in the licensing standards for each country, but since it is a formal license, there is no doubt even though it belongs to any country.

Asset conservation is always a debate.

The most reliable is “Conservation Trust”, in which all assets entrusted by customers are entrusted to a third-party financial institution such as a trust bank.

Brokers cannot withdraw funds without permission from the customer.

Even if the broker goes bankrupt, the customer’s assets (balance at that time) are always guaranteed.

Trust protection obligations depend on the regulations of the licensing country.

Even if each broker is not required by the license, it does not mean that they are not doing anything, and each broker has voluntary trust insurance.

The guaranteed amount may be the full amount or an upper limit may be set.

The following is the license acquisition status and asset conservation situation of each broker.

Here, the brokers with conservation trust (unlimited) are fairly reliable.

XM and HotForex have an insurance, although there is no conservation trust and only segregation of funds, the maximum amount is high, so it can be said that they are quite reliable.

In the case of conservation trust, all the customer’s assets are deposited with a third-party financial institution.

Some brokers do only segregated management, even if they don’t do conversation trust.

You may feel risky if there is no asset guarantee system, but if you are worried, avoid using that broker.

Even if you use it, you need to take as much risk measures as possible, such as withdrawing profits every time when you get it.

| Regulated by | Asset Conservation | |

|---|---|---|

| XM | FSA(Seychelles) AFSL(Australia) CySEC(Cyprus) | Segregation of Funds +AIG Insurance (Max 100m USD) |

| FXGT | FSA(Seychelles) | Conservation Trust (Unlimited) |

| FBS | CySEC(Cyprus) IFSC(Belize) ASIC(Australia) FSCA(RSA) | Conservation Trust (Unlimited) |

| GEMFOREX | FSP(New Zealand) | Segregation of Funds |

| HotForex | CySEC(Cyprus) FSA (Saint Vincent and the Grenadines) FCA(United Kingdom) DFSA(Dubai) FSCA(RSA) FSA(Seychelles) | Segregation of Funds +RENAISSANCE Insurance (Max 500m EUR) |

| TitanFX | VFSC(Vanuatu) FSC(Mauritius) | Segregation of Funds |

| LAND-FX | FCA (United Kingdom) FSCS (United Kingdom) FSA (Saint Vincent and the Grenadines) | Segregation of Funds |

| Axiory | IFSC(Belize) | Conservation Trust (Unlimited) |

| Tradeview | CIMA(Cayman) | Conservation Trust (Mas 35,000 USD) |

| iFOREX | FSC(British Virgin Islands) | Segregation of Funds |

| TMGM | ASIC (Australia) VFSC (Vanuatu) | Conservation Trust (Max 30m AUD) |

② Maximum Leverage

How much is the maximum leverage?

The highest leverage is not the best. But the higher it is, the bigger the profit.

Even if the broker offers ultra-high leverage, the maximum leverage will be automatically changed (restricted) depending on the margin balance.

You can also change the leverage yourself.

Again. You can change the leverage settings by yourself.

You can even have 1:1, means no leverage.

Somebody says forex is risky because it’s high leverage.

If you are worried, you can lower the leverage.

It is dangerous because you trade with maximum leverage even though you are a novice.

Below is a summary of the maximum leverage of each broker, the conditions for leverage restrictions based on margin balance, etc., and the leverage settings that you can set yourself.

Please use it as a guide to how much leverage you can trade with the amount of funds you plan to invest.

| Max Leverage | Leverage restrictions | Leverage Settings | |

|---|---|---|---|

| XM | 1:888 | Total balance of all accounts ~$20,000 : 1:888 ~$100,000 : 1:200 $100,000~:1:100 | 1:1~1:888 (16 steps) |

| FXGT | 1:1000 | Set by Transaction volume (Leverage is low when trading volume is high) | 1:1~1:1000 (As you like) |

| FBS | 1:3000 | Account balance ~$200 : 1:3000 ~$500 : 1:2000 $500~ : 1:500 | 1:50~1:3000 (7 steps) |

| GEMFOREX | 1:1000 | Account Balance ~$20,000 : 1:1000 $20,000~ : 1:500 | cannot change |

| HotForex | 1:1000 | Account Balance ~$300,000 : 1:1000 $300,000~ : 1:75 | 1:1~1:1000 (11 steps) |

| TitanFX | 1:500 | No restrictions | 1:1~1:500 (8 steps) |

| LAND-FX | 1:500 | Account Balance ~$50,000 : 1:500 $50,000~ : 1:200 OR position 50 lots more : 1:200 | 1:1~1:500 (9 steps) |

| Axiory | 1:777 | Account Balance ~$100,000 : 1:400 ~$200,000 : 1:300 $200,000~ : 1:200 | 1:1~1:777 (8 steps) |

| Tradeview | 1:400 | Account Balance ~$100,000 : 1:500 $100,000~ : 1:100 | 1:1~1:500 (As you like) |

| iFOREX | 1:400 | No restrictions | cannot change |

| TMGM | 1:500 | No restrictions | 1:1~1:500 (20 steps) |

③ Negative Balance Protection (NBP)

Is a negative balance protection system adopted?

All of the brokers I’m introducing here offer negative balance protection system.

Remember, the negative balance protection system is just a remedy when the account balance becomes negative due to sudden market fluctuations.

Stop out is triggered when certain conditions are met before they become negative.

That is the Current Margin Rate (%).

Margin rate at which loss cut is triggered is set for each broker.

Below is a summary of the margin call and stop out criteria for each broker.

| Margin Call | Stop Out | |

|---|---|---|

| XM | 50% | 20% |

| FXGT | 50% | 20% |

| FBS | 40% | 20% |

| GEMFOREX | 50% | 20% |

| HotForex | 50% | 20% |

| TitanFX | 90% | 20% |

| LAND-FX | 50% | 30% |

| Axiory | 50% | 20% |

| Tradeview | None | 100% |

| iFOREX | 0.25% | 0% |

| TMGM | 120% | 40% |

④ Product

Is there a product you want to trade?

Whether or not the broker provides products that you want to trade, it’s shoud be an important criteria to choose broker.

If you want to trade only major currency pairs like EUR/USD, USD/JPY, it doesn’t matter which broker you choose.

All brokers handle major currencies.

On the other hand, if you want to trade cryptocurrencies with high leverage, or if you want to trade individual stocks instead of stock indexes, the number of brokers is limited.

The following are the products handled by each broker.

You can see that there is a considerable difference even if you look at the numbers.

Of course, all brokers handle currency pairs, but there is a difference in the number of currencies handled, depending on whether they are major currencies or minor currencies.

CFD as well. It’s only metal such as gold and silver, or oil and stock indexes.

Cryptocurrencies and individual stocks, only some brokers can provide them.

Cryptocurrencies are offered by several brokers, but FXGT is by far the most popular in cryptocurrency trading.

Only FXGT can trade cryptocurrencies with 500 times higher leverage.

Individual stocks are also popular. iFOREX boasts an overwhelming number of products.

It is reviewed regularly, but you can buy and sell over 800 stocks.

FXGT also handles individual stocks. This is mainly US stocks. The number of stocks is over 50, which is not as high as iFOREX, but the leverage of the spot stock of iFOREX is 20 times, while that of FXGT is 50 times.

These products may be reviewed on a regular basis. Also, even with the same broker, the products that you can trade will change depending on the account type.

Please check the official website of each broker for details.

| Currency | CFD | Crypto | Stocks | |

|---|---|---|---|---|

| XM | 57 | 41 | – | – |

| FXGT | 48 | 13 | 30 | 53 |

| FBS | 37 | 10 | 5 | 66 |

| GEMFOREX | 31 | 14 | – | – |

| HotForex | 53 | 41 | 12 | 56 |

| TitanFX | 60 | 36 | 18 | 65 |

| LAND-FX | 67 | 22 | – | – |

| Axiory | 61 | 19 | – | 78 |

| Tradeview | 61 | 16 | 5 | – |

| iFOREX | 83 | 100 | 17 | 845 |

| TMGM | 60 | 29 | 5 | – |

⑤ Fees

Are the fees low?

As traders trade every day, the lower commission is the better.

Everyone tend to focus only on the spread width, but there are considerable differences depending on the broker, trading time of day, and trading products.

Brokers also have narrow spread accounts. (ECN account)

Although it is not possible to compare with each company, but the following is,

- Average spreads of major currency pairs of STP account

- Commission fees of ECN account

Please check the official page of each broker for details.

| EUR/USD (Avg. Spreads) | USD/JPY (Avg. Spreads) | ECN Commissions (Round) | |

|---|---|---|---|

| XM | 1.7 pips | 1.6 pips | $10 |

| FXGT | 1.6 pips | 1.6 pips | $10 |

| FBS | 1.1 pips | 2.0 pips | $12 |

| GEMFOREX | 1.3 pips | 1.3 pips | No ECN |

| HotForex | 1.2 pips | 1.7 pips | $8 |

| TitanFX | 1.2 pips | 1.33 pips | $7 |

| LAND-FX | 0.8 pips | 0.8 pips | $7 |

| Axiory | 1.2 pips | 1.2 pips | $6 |

| Tradeview | 1.7 pips | 1.8 pips | $5 |

| iFOREX | 0.7 pips | 1.0 pips | No ECN |

| TMGM | 1.6 pips | 1.8 pips | $7 |

⑥ Account Currency

What can you select as account currency?

If the currency of your bank account is different from the currency of your trade account, exchange fee will be charged for each deposit and withdrawal.

Therefore, unless you have a specific reason, I recommend opening a trading account in the same currency as your bank account.

Of course, you don’t have to do so. Select it with the product you trade.

For example, a trader who mainly trades EUR currency pairs may create a EUR trading account even if the bank account is JPY.

Also, as I will explain later, it is necessary to decide in consideration of the ease of deposit and withdrawal.

I live in Thailand, and HotForex is fully compatible with local banks in Thailand and I can deposit and withdraw with no fees, so I am currently using HotForex as my main broker even though my bank account currency is THB and HotForex account is USD.

In this way, decide the account currency according to the currency pair you trade, the area you live in, the currency of your bank account, and so on.

| USD | EUR | JPY | Others | |

|---|---|---|---|---|

| XM | ○ | ○ | ○ | GBP, CHF, AUD, RUB, PLN, HUF, ZAR, SGD, THB |

| FXGT | ○ | ○ | ○ | BTC, ETH, XRP, USDT |

| FBS | ○ | ○ | ○ | – |

| GEMFOREX | ○ | – | ○ | – |

| HotForex | ○ | ○ | ○ | NGN |

| TitanFX | ○ | ○ | ○ | SGD, AUD |

| LAND-FX | ○ | – | ○ | – |

| Axiory | ○ | ○ | ○ | – |

| Tradeview | ○ | ○ | ○ | GBP |

| iFOREX | ○ | – | ○ | – |

| TMGM | ○ | ○ | – | GBP, AUD, NZD |

⑦ Funding Method (Deposit & Withdrawal)

Is the funding method convenient?

There are various deposit and withdrawal methods for forex brokers.

The main means are as follows.

| Method | Description | Advantage | Disadvantage |

|---|---|---|---|

| Bank Transfer (Domestic) | Domestic bank account prepared by broker | – Quick – Low commission | Withdrawals are often made from overseas banks, long time and high fees |

| Bank Transfer (International) | Overseas bank account prepared by broker | – Nothing special | – take time (3-5 days) – high fees |

| Credit Card | Pay / refund by Credit Card | – Quick – No or low fees | – Withdrawal is up to the deposit amount (Profit cannot be withdrawn) |

| Web Money | Bitwallet, Skrill、NETLLER, etc. | – Quick – No or low fees | – Need to prepare an account in advance – Some countries do not allow use |

| Money Transfer Service | Curfex, PayTrust, FasaPay, etc. | – Quick – Lower fees than International bank transfer | – Only few brokers can accept |

| Cryptocurrency | Bitcoin, etc | – Quick – No or low fees | – Need to prepare crypto wallet – Only few brokers can accept |

For bank transfers, it depends on the broker and your area whether it supports local banks. Check out the official website.

*For Thai residents: XM, FBS, HotForex, LAND-FX and iForex provide Thai local bank transfer service.

Regarding deposits, I think that those who are comfortable with credit cards will be a powerful deposit method.

The deposit is quick. Most of them are free of charge.

However, I do not recommend credit cards for withdrawals.

Since you can only withdraw up to the deposit amount, you can only withdraw to the bank account anyway.

Also, depending on the credit card company, you will not be able to withdraw money after a certain period of time has passed since you made the deposit.

This is because withdrawals to credit cards are processed by canceling the usage details at the time of deposit (partial cancellation if the deposit amount and withdrawal amount are different).

As far as I know, VISA is limited to 3 months.

The mainly deposit and withdrawal methods of each broker are summarized below.

It changes quite suddenly, and the methods that can be used also change depending on the country of residence and the currency of the account.

Please check the official website for details.

| Bank | Credit Card | Web Money | Transfer Service | Crypto | |

|---|---|---|---|---|---|

| XM | ○ | ○ VISA, JCB | ○ bitwallet, NETLLER, Skrill | – | – |

| FXGT | ○ | ○ VISA, MasterCard, JCB | ○ bitwallet, STICKPAY | – | ○ BTC, ETH, XRP, USDT |

| FBS | ○ | ○ VISA, JCB | ○ bitwallet, STICKPAY, PerfectMoney | – | – |

| GEMFOREX | ○ | ○ VISA, MasterCard, AMEX, Diners, Discover, JCB | ○ STICKPAY, PerfectMoney | – | ○ BTC, ETH |

| HotForex | ○ | ○ VISA, MasterCard, JCB | ○ bitwallet | FasaPay, VLOAD | ○ ETH, XRP, LTC, BTC(bitpay) |

| TitanFX | ○ | ○ VISA, MasterCard | ○ bitwallet, STICKPAY, NETLLER, Skrill | – | – |

| LAND-FX | ○ | ○ VISA, MasterCard | ○ STICKPAY, Skrill | – | ○ BTC |

| Axiory | ○ | ○ VISA, JCB, UnionPay | ○ STICKPAY, NETLLER, Skrill | ○ curfex, VLOAD | – |

| Tradeview | ○ | ○ VISA, MasterCard | ○ bitwallet, uphold | ○ TransferMate, FasaPay | – |

| iFOREX | ○ | ○ VISA, MasterCard, AMEX, JCB | ○ bitwallet | – | – |

| TMGM | ○ | ○ VISA, MasterCard, UnionPay | ○ STICKPAY, NETLLER, Skrill, Alipay | ○ FasaPay | – |

⑧ Bonus Programs

Does a broker offer bonus programs?

As explained in another article about bonuses, they cannot withdraw themselves.

When you start trading, you can increase the margin by that amount of bonus, so you can trade in lots more than you have deposited, or depending on the broker, you can start trading without deposit. (XM, etc.)

In other words, bonus is an effective way to trade with no risk or with less risk.

If you are a beginner, it is a good idea to choose a broker based on their bonus programs.

| Non-Deposit Bonus | Deposit Bonus | Others | |

|---|---|---|---|

| XM | $30 | 50%/20% (Max $5,000) | XM Point (Cash Back) |

| FXGT | – | 150%/20% (Max $500/$20,000) | – |

| FBS | $100 *End of service | 100% (Max $10,000) | Cash Back |

| GEMFOREX | – | – | – |

| HotForex | – | – 50% (Max $1,000) – 30% (Max $7,000) | – Cash Back (2 types) – Loyalty Program |

| TitanFX | – | – | – |

| LAND-FX | – | 10% (Max $3,000) | Recovery Bonus (Cash Back) |

| Axiory | – | – | – |

| Tradeview | – | – | – |

| iFOREX | – | – | 3% Interest (Cash Back) |

| TMGM | – | 10% (Max $10,000/Q) | Gift Program |

⑨ Support

Does a broker offer good support?

I think this is an important point for beginners.

I recommend the broker who provides chat and phone service that match your trading hours.

Offer hours vary depending on where the support center is located in the country.

Even if you have a chat or phone call, it is meaningless if it does not match your living time and trading time, so that is also a checkpoint.

Also, there is a recommended way to check the quality of support.

Anything is fine, so try to contact them.

Especially recommended is chat.

Whether the response is quick when inquiring via chat, whether you can connect immediately if you want support in a language other than English, and whether there are different people when you make inquiries in a row.

If you are the same person every time, you will be worried about the support system (quantity).

I’m doing this quite a bit.

The image is a screenshot I took when I contacted TMGM recently.

I would like to try the phone call as well, but most of the brokers provides international phone number for me and the call charges will be high, so I will contact you by chat.

Ask a little difficult question. (For example, the status of asset conservation)

The response at that time will give you some idea of the quality of support.

Recommended for those who want to check the quality of support. Please, try it.

Below is the support status of each company.

All times are described by GMT.

| Phone | Live Chat | ||

|---|---|---|---|

| XM | ○ | ○ | ○ 24/5 |

| FXGT | ○ | – | ○ 0:00-14:00 |

| FBS | ○ | ○ (Call back) | ○ 24/7 |

| GEMFOREX | ○ | – | ○ 1:00-8:00(Weekday) |

| HotForex | ○ | ○ 24/5 | ○ 6:30~15:00(Weekday) |

| TitanFX | ○ | ○ 24/5 | ○ 24/5 |

| LAND-FX | ○ | – | ○ 24/5 |

| Axiory | ○ | ○ | ○ 1:30~14:30(Weekday) |

| Tradeview | ○ | ○ 24/5 | ○ 24/5 |

| iFOREX | ○ | ○ 4:00~12:00(Weekday) | – |

| TMGM | ○ | ○ 24/5 | ○ 24/5 |

Recommended Broker for Beginners

From my point of view, brokers who have a high evaluation of the following items are for beginners.

- Good support

- Gorgeous bonus programs

- Convenient deposit and withdrawal

- There are other ideas for beginners

Based on these, I will introduce the forex brokers for beginners that I recommend in the order of recommendation!

The Best Broker for Beginners 1st : XM

The 1st place is XM.

- Non-deposit bonus

- Good support

- Webinar for beginners

Although the spread is a little wide, you can get bonuses that can be used for trading even if you have not deposit, and there is good support. So it can be said that it is a trader for beginners.

Personally, the point is that the educational content is substantial.

Please take a look at the official website anyway.

\Just 3 minutes!!/

The Best Broker for Beginners 2nd : HotForex

The 2nd place is HotForex.

- Good support

- Lower spreads

- Education contents

Spreads are narrow and many products are available. It also has a wealth of educational content, making it suitable for beginners.

\Just 3 minutes!!/

The Best Broker for Beginners 3rd : FXGT

The 3rd place is FXGT.

- Good support

- Can trade cryptocurrencies with 1:1000 high leverage

- Offers gorgeous bonus programs

FXGT is famous for high leverage trading of cryptocurrencies.

It’s still a new broker, so it’s not well known, but it has enough support and the trading conditiions aren’t bad.

Customer assets are protected by trust protection, and it can be said that FXGT is a good broker.

\Just 3 minutes!!/

Open an Account

The Best Broker for Beginners 4th : FBS

The 4th place is FBS.

- Good support

- Lower spreads

- Gorgeous bonus program

FBS has narrow spreads and luxurious bonuses, so I recommend it.

In addition, FBS is a very reliable Forex broker with complete trust protection of customer assets.

It’s very famous because it’s a sponsor of FC Barcelona, but it’s a superb broker, so you can see why it’s not the only one that’s popular.

\Just 3 minutes!!/

The Best Broker for Beginners 5th : Axiory

The 5th place is Axiory.

- Good support

- Many funding method

- Low commission

- Website is easy to understand

The official website is explained in a very easy-to-understand even for beginners, there are plenty of deposit and withdrawal methods, and fees are low, so I think that it is definitely a company for beginners to open an account for the first time.

\Just 3 minutes!!/

The Best Broker for Beginners 6th : LAND-FX

The 6th place is LAND-FX.

- Good support

- Low commission

Chat is available 24 hours a day on weekdays.

LAND-FX offers only deposit bonus, but the spread is narrow and it is an easy-to-use broker for beginners.

\Just 3 minutes!!/

The Best Broker for Beginners 7th : TitanFX

The 7th place is TitanFX.

- Good support

- Low commission

TITAN-FX offers no bonus program, but it offers a 24-hour live chat service on weekdays, provides a lot of currency pairs, and has narrow spreads, so I think it can be a candidate.

Furthermore, TitanFX started offering Crypto trading in June 2021.

All Crytpo’s can be traded with 20x leverage.

\Just 3 minutes!!/

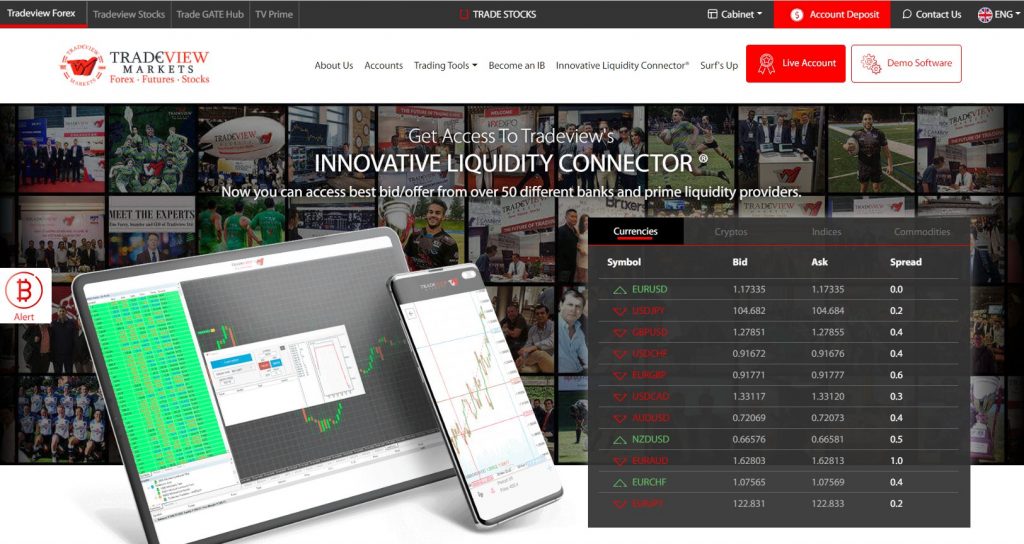

The Best Broker for Beginners 8th : Tradeview

The 8th place is Tradeview.

- Good support

- Low commission

Tradeview is a medium level broker. It is especially famous for its low fees for ECN accounts. Live chat is also available 24 hours a day on weekdays and is recommended for beginners.

\Just 3 minutes!!/

The Best Broker for Beginners 9th : TMGM(TradeMax)

The 9th place is TMGM(TradeMax).

- Good support

- Narrow spread and VIP support on VIP account

TMGM is a medium level broker same as Tradeview. Live chat is also available 24 hours a day on weekdays and is recommended for beginners.

\Just 3 minutes!!/

The Best Broker for Beginners 10th : iFOREX

The 10th place is iFOREX.

- Good support

- Low commission

- Unique cashback program

- Many products

iFOREX is a close-up of only high-leverage trading always, but it doesn’t mean that beginners can’t use it.

The spreads is narrow, so it can be recommended for beginners.

iFOREX offers many products.

They also offer a lot of individual stocks, so it is recommended for those who want to use it not only for Forex but also as a platform for general investment.

\Just 3 minutes!!/

Summary

I think that somehow you can see the brokers you want to use.

This time, I picked up the brokers recommended for beginners, but of course I can also recommend the brokers that are not in the ranking.

Traders who are accustomed to trading to some extent, those who want to trade cryptocurrencies with high leverage like FXGT, those who want to trade stocks like iForex, those who want to thoroughly seek low cost, etc. The brokers change depending on.

Again, I think the funds should be distributed across multiple accounts to reduce risks.

In that sense, if you are uncertain about choosing a broker, I recommend that you actually open an account with some brokers and operate it.

By actually trading, you will be able to understand the characteristics, advantages and disadvantages of the vendor more clearly.

Try it!!

コメント