XM provides a convenient Forex calculation tool.

Sometimes the calculation is very complicated, such as how much pips is, how much loss / profit is in terms of stop loss and take profit settings, and this should be the reason why forex beginners give up.

XM offers several calculation tools that allow you to get answers in one shot, such as calculating pip values and margin requirements.

- XM’s Forex Calculation tools

- What can be calculated with XM’s Forex Calculators

- How to user Forex Calculators

What is XM Forex Calculators?

It is a calculation tool provided by XM on the official website.

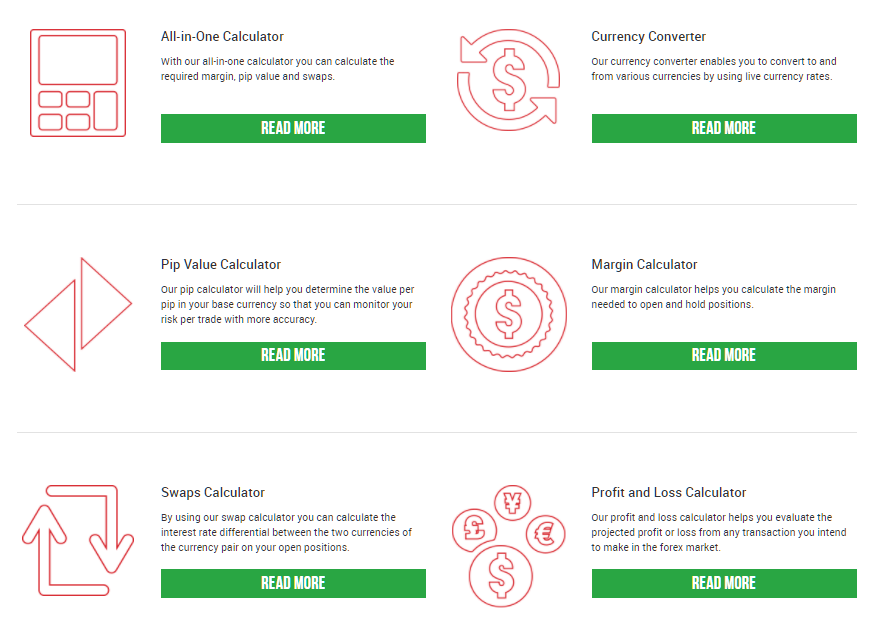

XM provides the following 6 types of calculation tools.

- Currency Converter

- Pip Value Calculator

- Margin Calculator

- Swaps Calculator

- Profit and Loss Calculator

- All-in-One Calculator

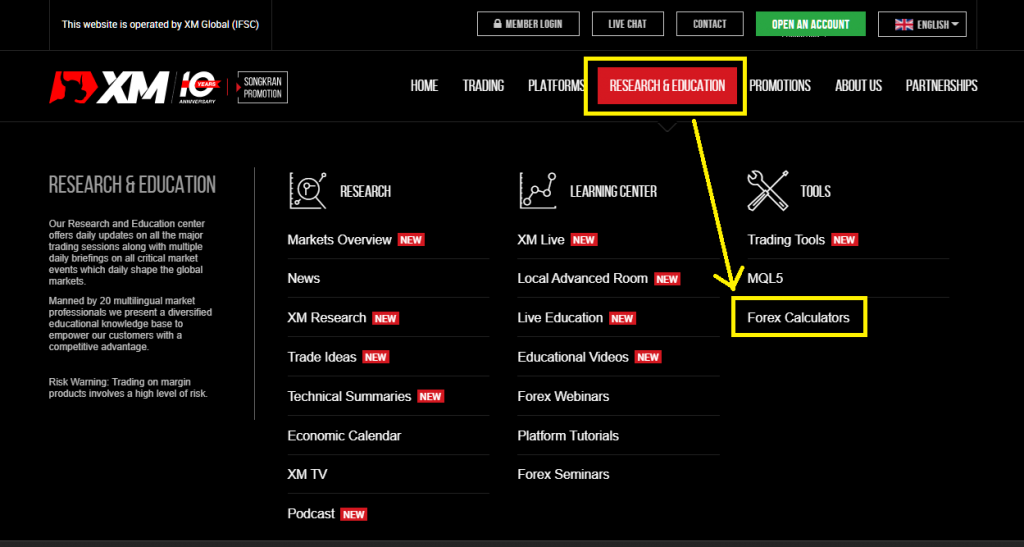

How to Access XM Forex Calculators

Click “RESEARCH & EDUCATION” -> “Forex Calculators”

How to User XM Forex Calculators

From here, I will explain the specific usage of each calculation tool.

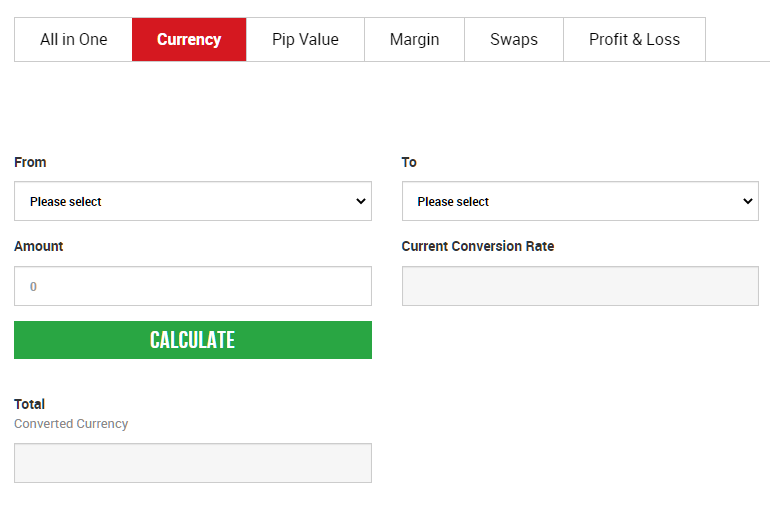

Currency Converter

A tool to check the current real-time rate of currency pairs.

The rate itself can be checked from MT4 and MT5, so it may not be a tool to use.

Also, the only rate that can be confirmed is the currency pair.

You cannot check the rates of CFD products such as gold, stock indexes and oil.

- I want to know the current exchange rate in real time

- I want to know the amount converted into currency

How to user Currency Converter

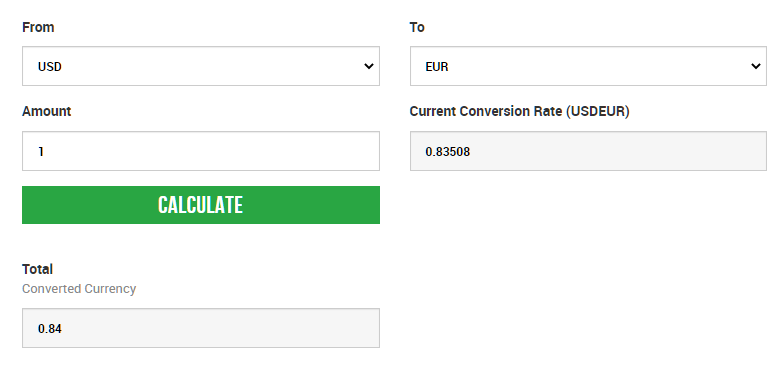

Select the currency you want to convert.

Please enter 1 or more for the amount.

Click Calculate to see the amount converted at the current rate.

The image is the rate converted from USD (US dollar) to EUR (Euro).

Pip Value Calculator

You can know the amount of money per pip, which is different for each currency pair.

When you’re just starting Forex, you must be confused in pips.

Depending on the currency pair, the amount of money in the unit of 1 pips will differ.

How much profit / loss will you get if you go up / down by 1 pips?

This pip value calculator makes it easy to calculate.

- I want to know the value of 1 pip

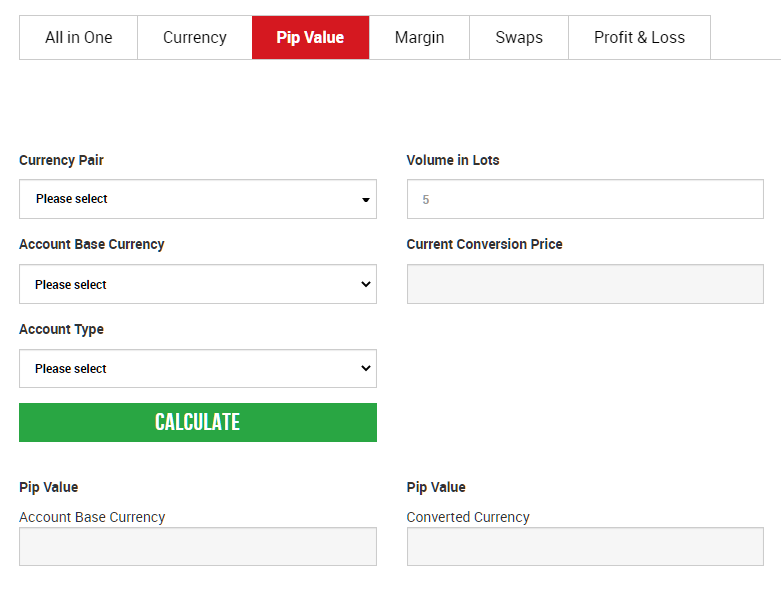

How to user Pip Value Calculator

Select Currency Pair, Account Base Currency, Account Type, Volume in Lots, then click CALCULATE.

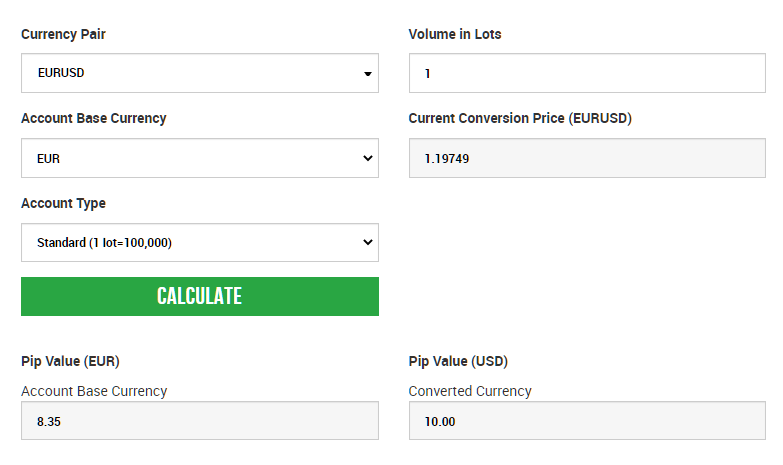

In XM, the contract size of the standard account is 1 lot = 100,000 currencies.

In other words, if you specify 1 for the number of lots and calculate, you can see how much profit / loss will be generated if you move 1 pips when you trade 1 lot.

The image below is the pips value when trading EURUSD with a standard account.

If you trade EURUSD for 1 lot (100,000 currencies), moving 1 pips will move 8.35 euros or 10 dollars.

Margin Calculator

You can calculate how much margin you need to have a position.

This may be the most used tool at first.

Margin can be simulated with varying leverage.

- I want to know how much margin I need to place an order

- I want to know how the required margin changes when the leverage is changed

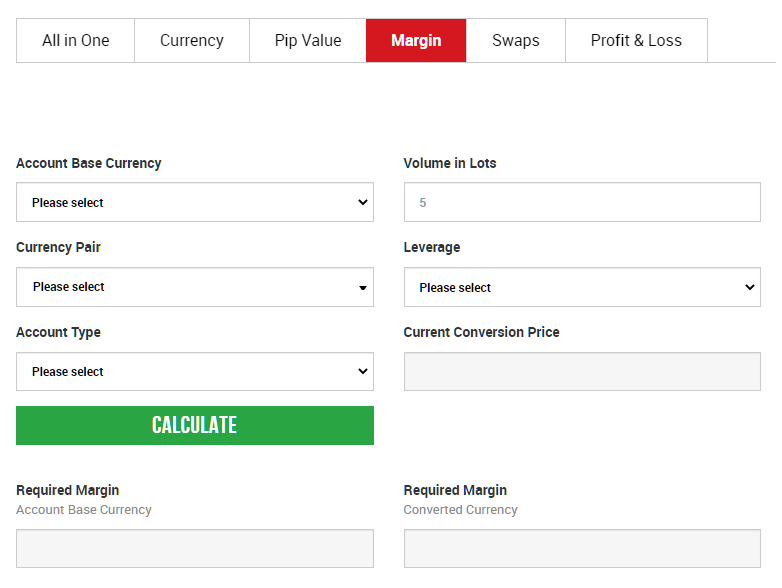

How to Use Margin Calculator

Select Account Base Currency, Currency Pair, Account Type, Volume in Lots and Leverage.

The maximum leverage of XM is 888 times, but you may change the leverage yourself to reduce the risk, such as when trading a highly volatile currency pair.

This margin calculation tool allows you to change the leverage from 1: (that is no leverage) to 1:888.

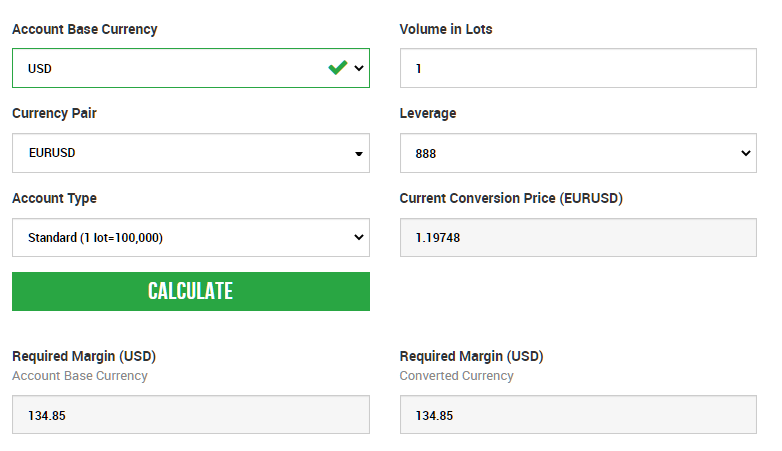

The image is the margin required when trading EURUSD in 1 lot = 100,000 currencies.

If you take advantage of the maximum leverage of 888 times, you can see that it is possible to trade 1 lot of EURUSD with a margin of 134.85 USD.

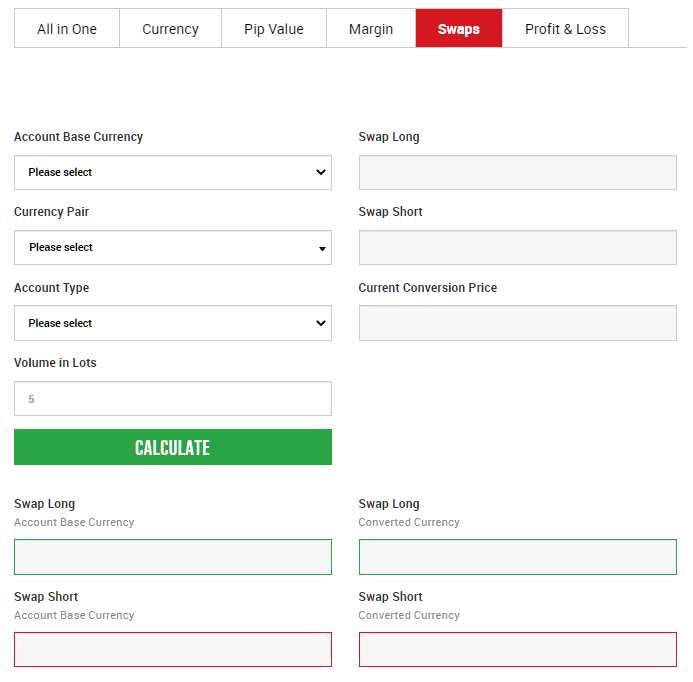

Swaps Calculator

Swap is the interest rate that is charged when you hold a position over night.

XM Swaps Calculator allows you to calculate different swap points for each currency pair.

In addition, swaps differ depending on whether you are in a sell position or a buy position.

- I want to know the swap interest rate when holding a position across days

- I want to know the swap of each sell position and buy position

How to User Swaps Calculator

Select Account Base Currency, Currency Pair, Account Type ad Volume in Lots.

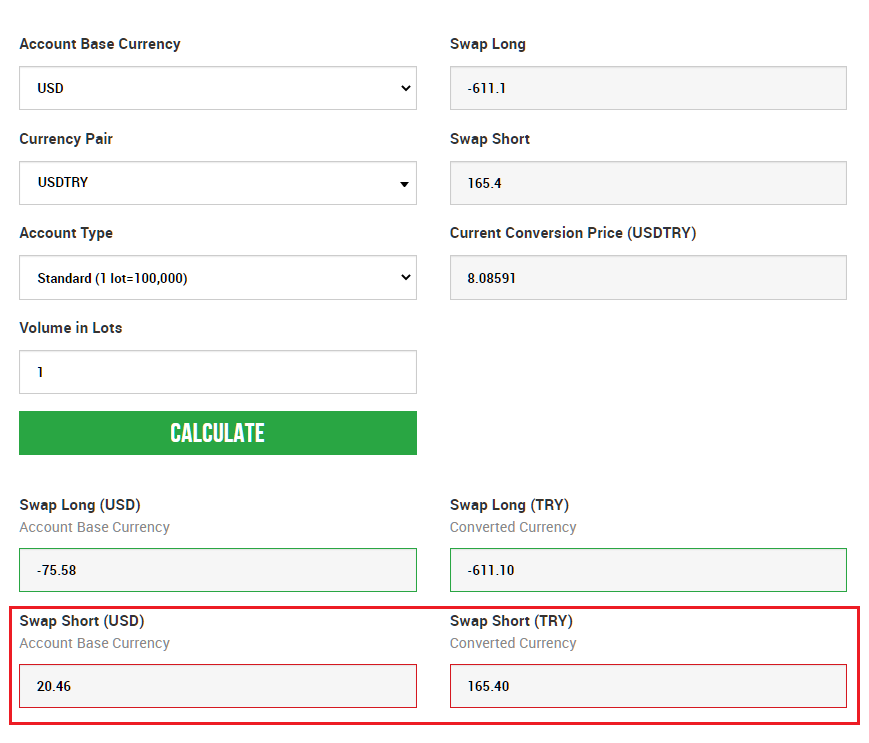

The image shows the swap calculation result when one lot of USDTRY (US dollar Turkish lira) with a large swap is traded.

The swap interest rate is caused by the policy interest rate difference of the issuing country of the currency to be traded, but there is a method of trading aiming at this swap point.

Turkish lira and South African rand are famous for their large swap points.

As you can see in this image, if you have one lot of USDTRY sell position, you can get $ 20 swap every day.

XM swap notes

Swap points are charged daily, but in the case of XM, every Wednesday (Wednesday to Thursday), the holding position is given 3 days worth of swap.

(To settle one week’s swap in 5 days from Monday to Friday)

Be careful if you hold a large currency pair with negative swaps from Wednesday to Thursday.

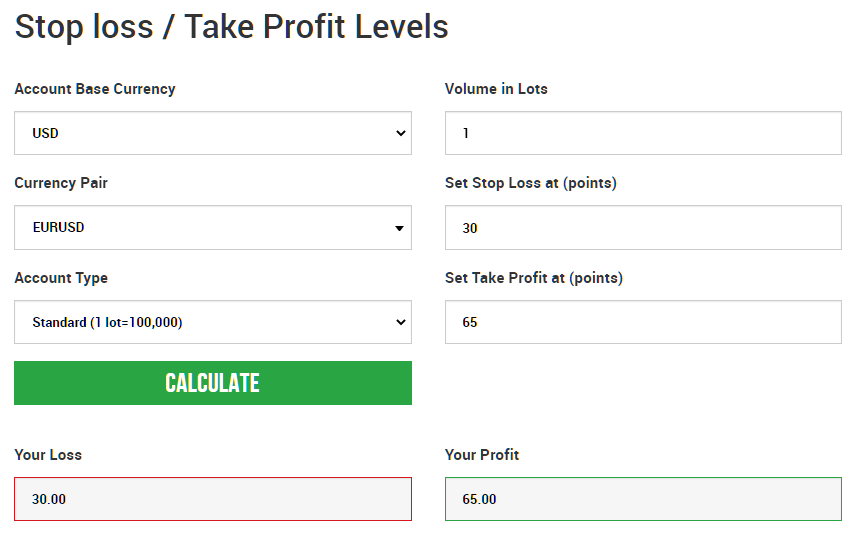

Profit and Loss Calculator

With XM, you can set stop loss and take profit setting.

With this Profit and Loss Calculator, you can calculate how many pips you need to move from the price at the time of order to get how much loss / profit.

- I want to know how much loss / profit will be when the set stop loss / take profit is reached.

How to use Profit and Loss Calculator

Set all of parameters from Account Base Currency to Stop Loss and Take profit Points.

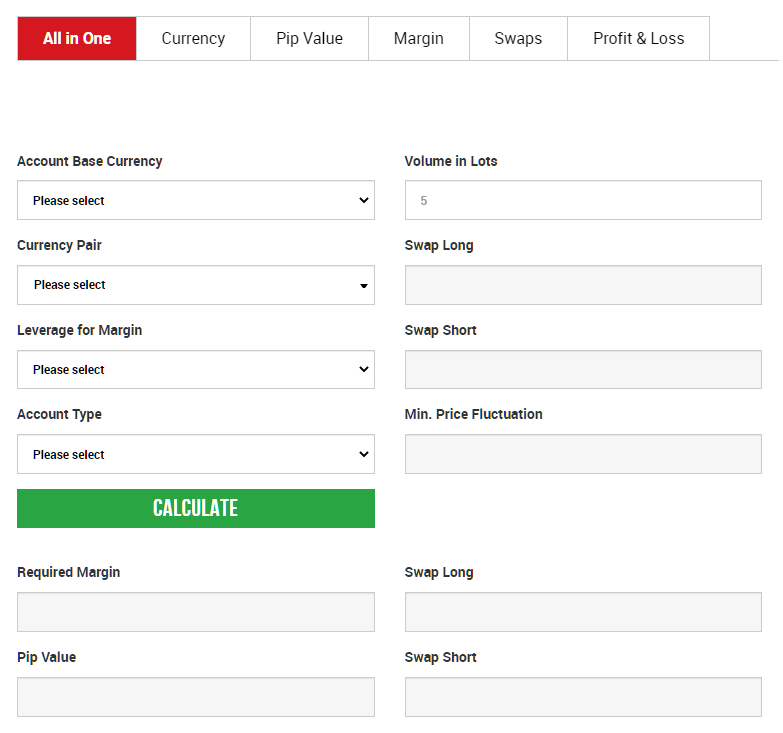

All-in-one Calculator

Of the above calculations, it is a convenient tool that calculates the required margin, pip value, and swap at once.

The usage is almost the same, enter from the basic currency of the account to the number of trading lots and calculate.

Summary

What did you think.

I still use this calculation tool when trading unfamiliar currency pairs.

Especially, I think the Pip Value Calculator and the Margin Calculator are very useful.

Please make use of it.

\Just 3 minutes!!/

コメント